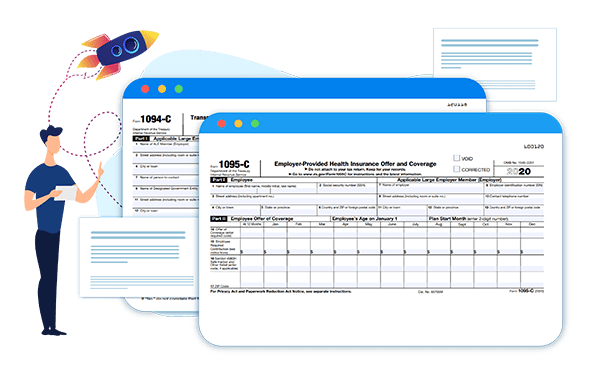

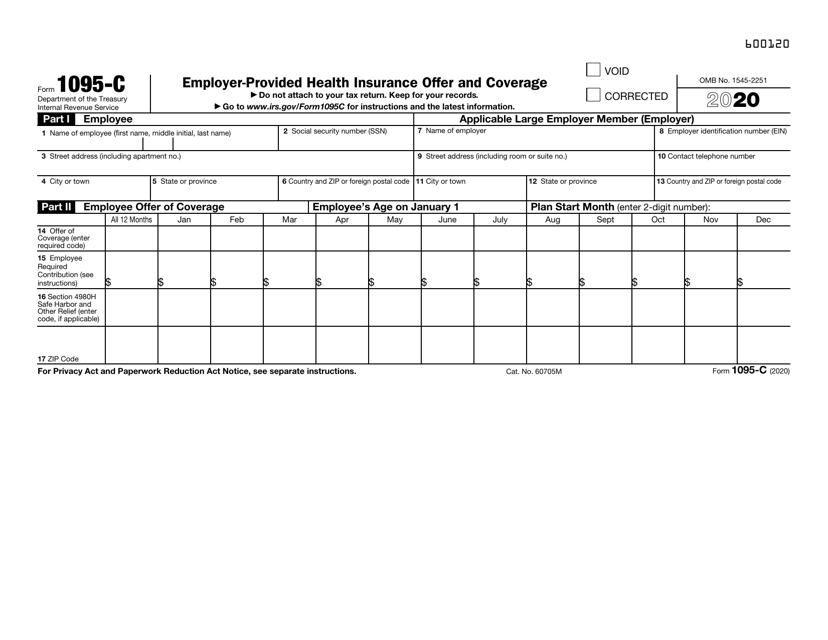

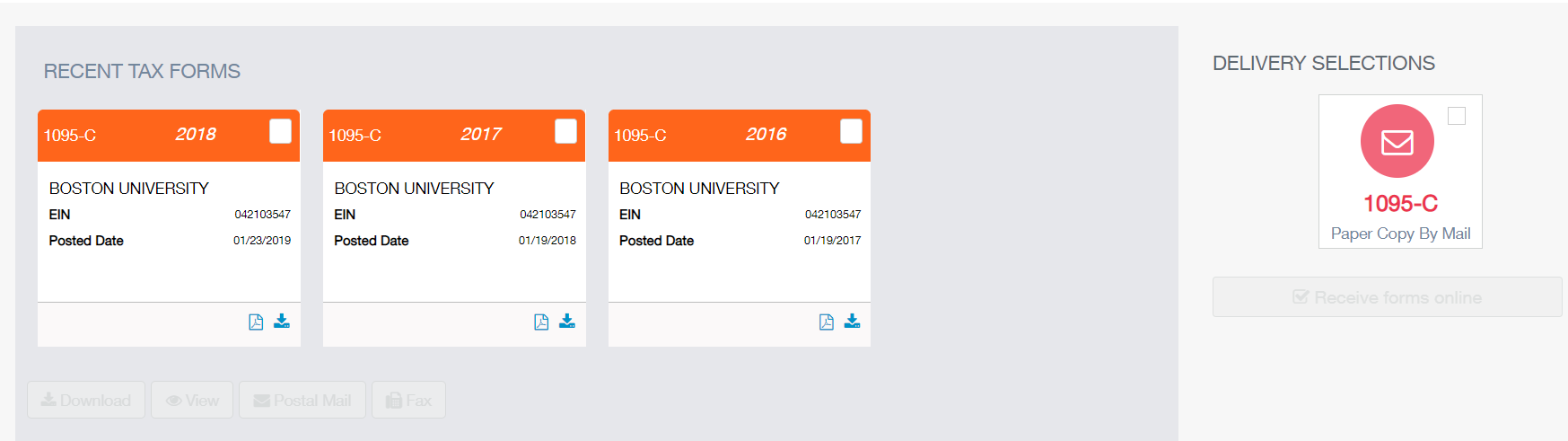

Instructions for Forms 1095C TaxBandits The Form 1095C is the EmployerProvided Health Insurance Offer and Coverage, designed by the IRS to The IRS released its draft IRS Forms 1094C and 1095C, dated as draft as of There are no changes to the Form 1094C from the prior year However, there are some significant changes to the 1095C Of course, depending on how these changes impact your reporting on 1095C, your reporting on the 1094C may also change About the Form 1095C The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue To view your Form 1095C in HR/CMS SelfService For anyone who previously chose suppression of paper forms, the Form 1095C

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

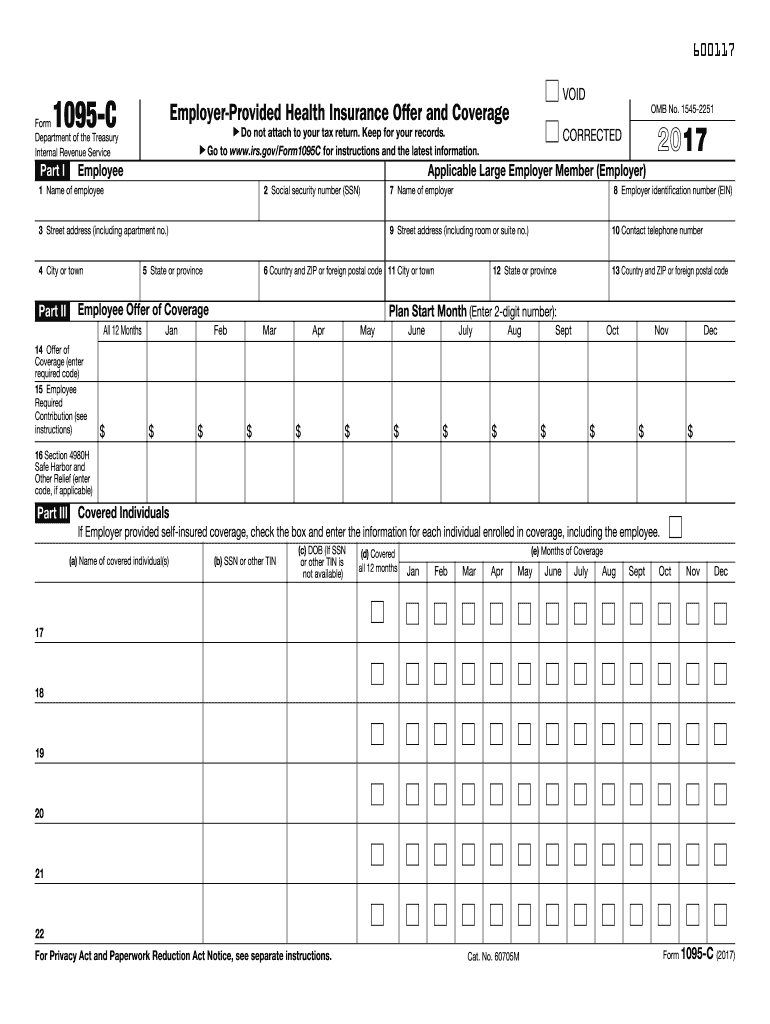

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

2020 form 1095-c changes

2020 form 1095-c changes- Changes Coming for Form 1095C On , the Internal Revenue Service (IRS) provided a draft that shows changes to the tax forms for Rest assured Tango is reviewing and preparing to comply with the changes The 1094C form that gets transmitted to the IRS and shows the overall compliance for an EIN remains the same An ALE should furnish an ACA Form 1095C to each of its fulltime employees by , for the calendar year An ALE should file ACA Forms 1094C and 1095C by , if you choose to file electronically, and the Form should file by , if filing on paper Click here to know the State filing deadlines

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

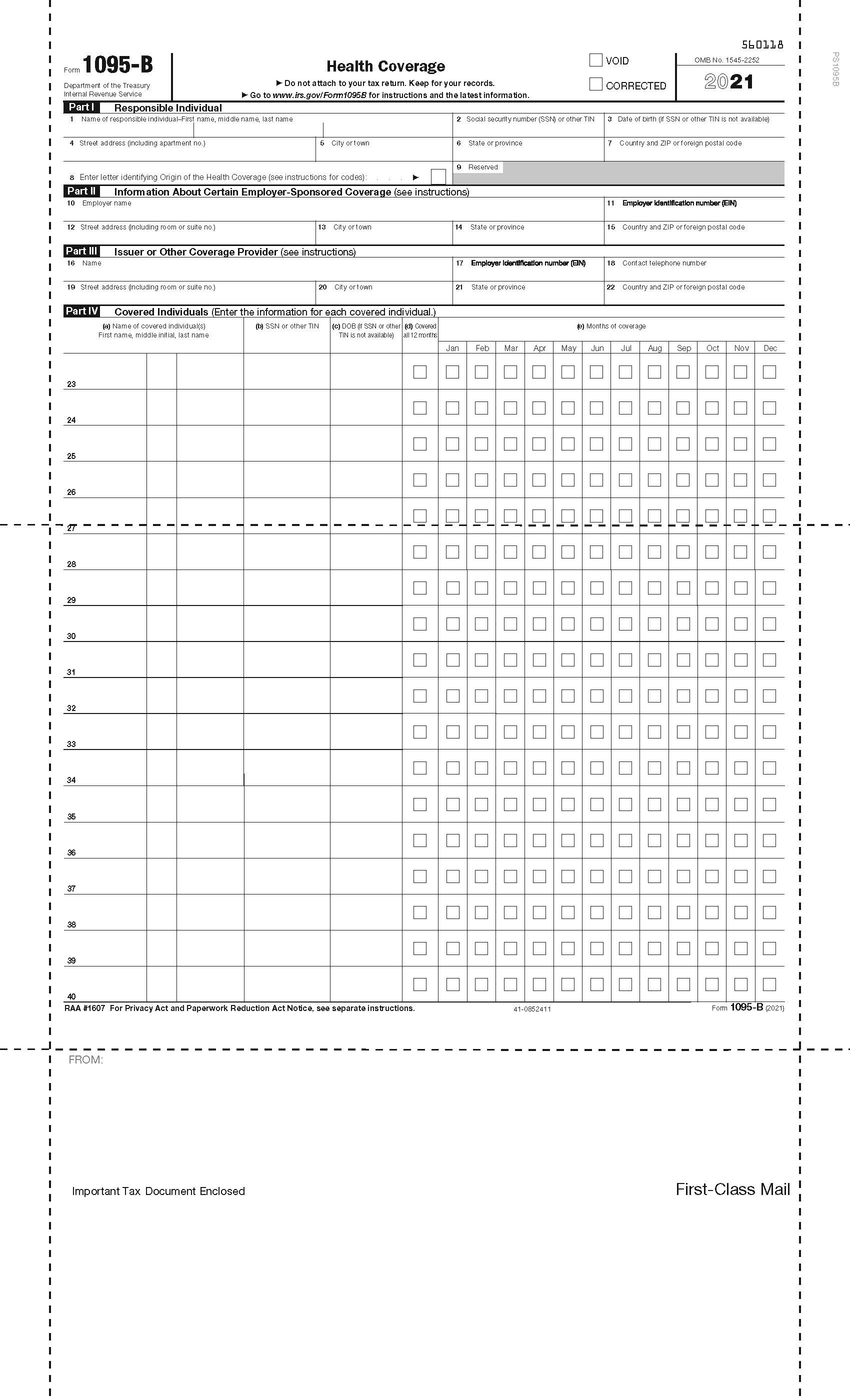

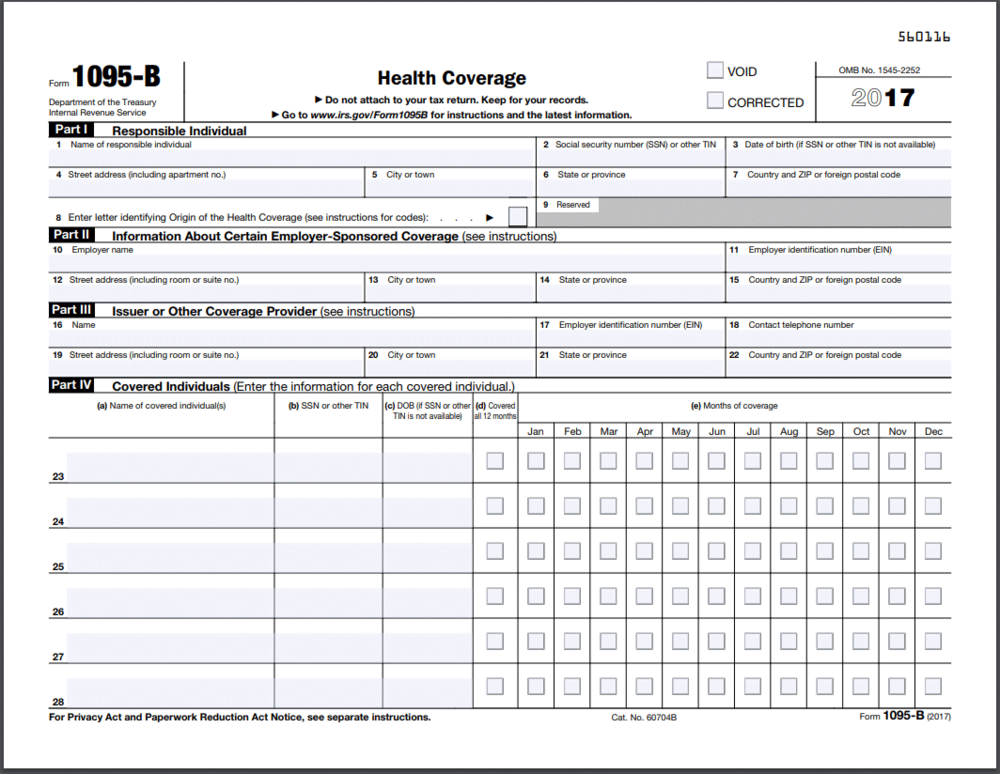

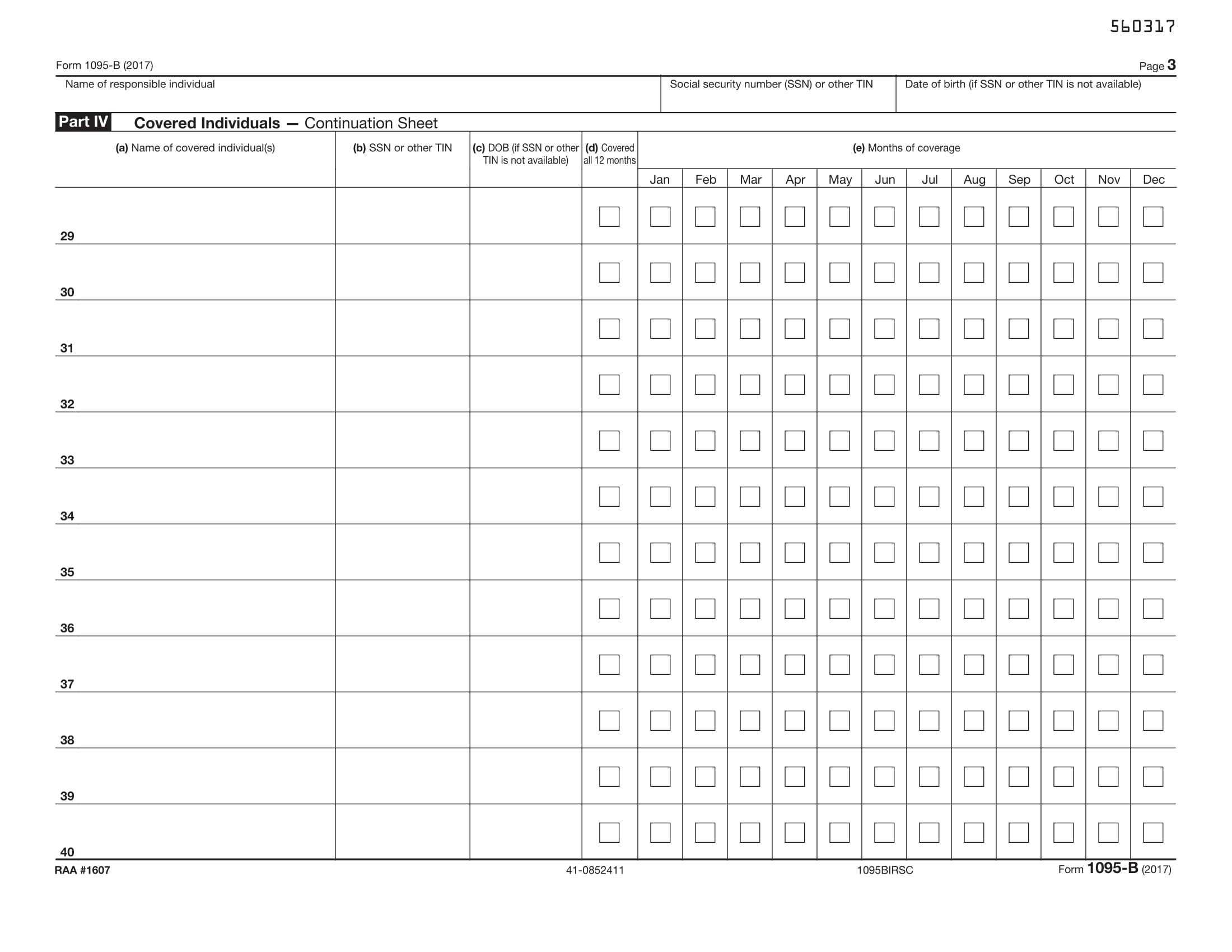

ACA 1095 Compliance Update for TY The IRS has just released their finalized 1094B, 1094C, 1095B, and 1095C instructions and tax forms for Tax Year ! Availability of 1095 Forms for In accordance with requirements of the Affordable Care Act and various reporting requirements of other jurisdictions, UC employees and retirees will receive 1095B and/or 1095C forms verifying their health coverage for The forms and instructions also require employers to include information concerning Individual Coverage Health Reimbursement Arrangements (ICHRAs), if applicable The instructions for Form 1094C state that offers of ICHRA coverage count as offers of minimum essential coverage and both Forms 1095B and 1095C have new codes for information

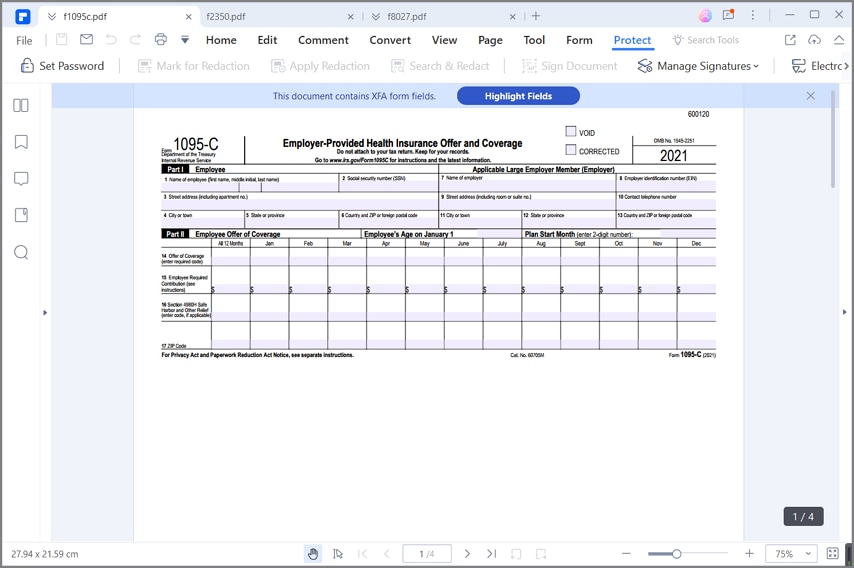

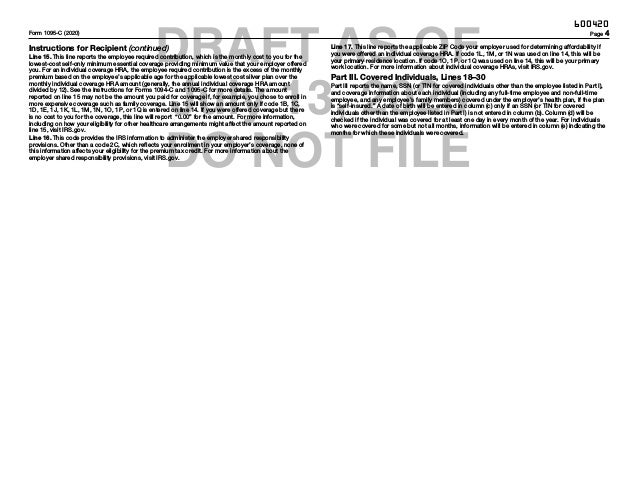

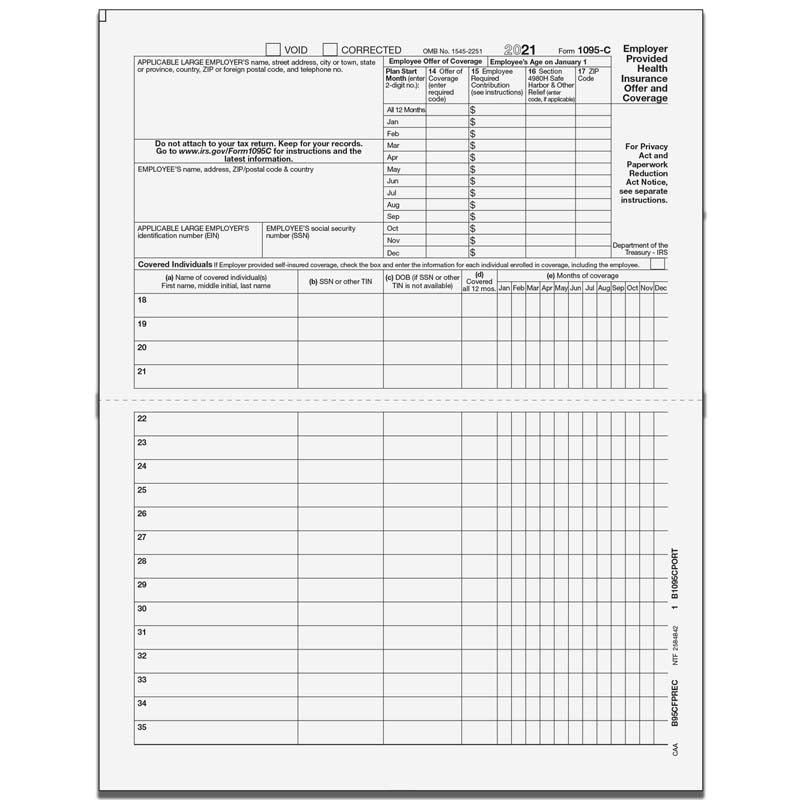

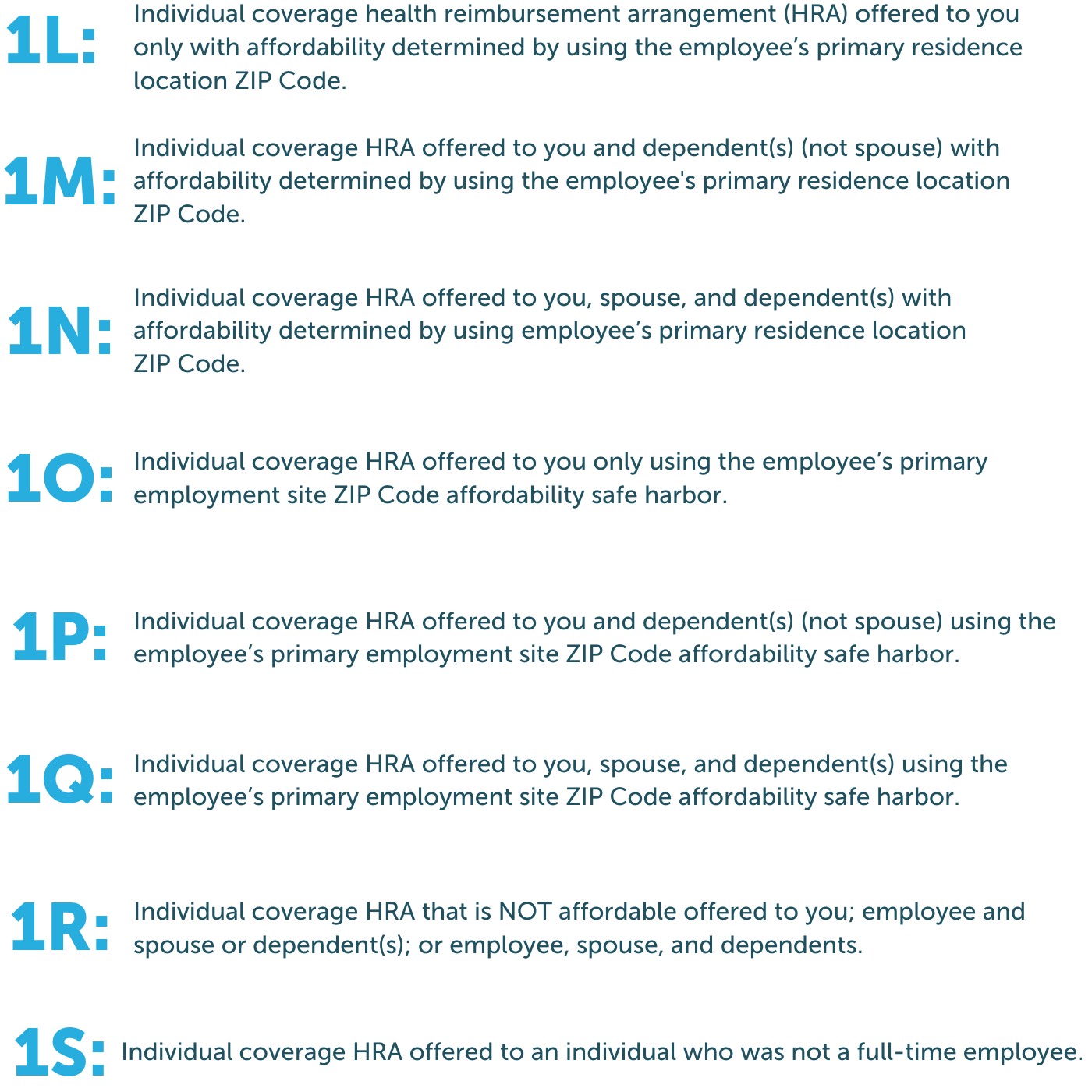

On the IRS released the draft iteration of the Form 1095C At first glance, it appears there have been significant changes to the Form 1095C However, in reality, most employers will complete the Form 1095C exactly the way they did in previous years The remainder of this article briefly discusses the changes made in the draft Form Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was coveredThis form is sent out by the insurance provider rather than the employer The new form covers HRA plan years starting Jan 1, New codes for the 1095C For tax year , Form 1095C gets updated with brandnew offer codes employers can enter in line 14 You'll use it to indicate the type of HRA coverage offered to employees

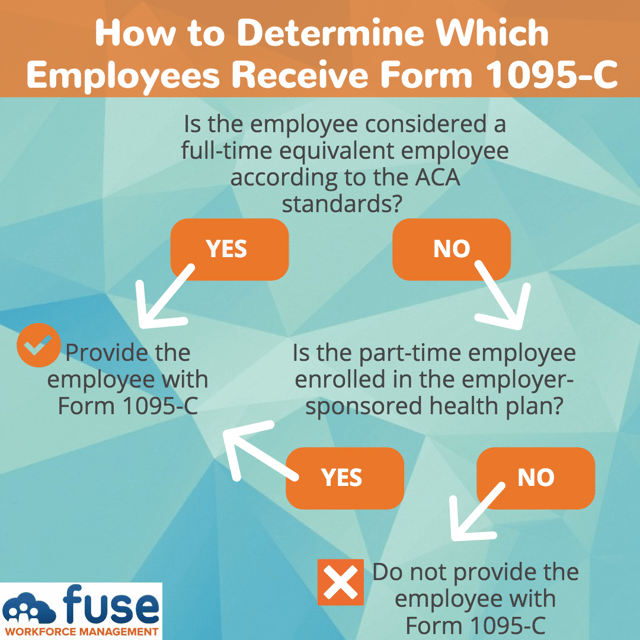

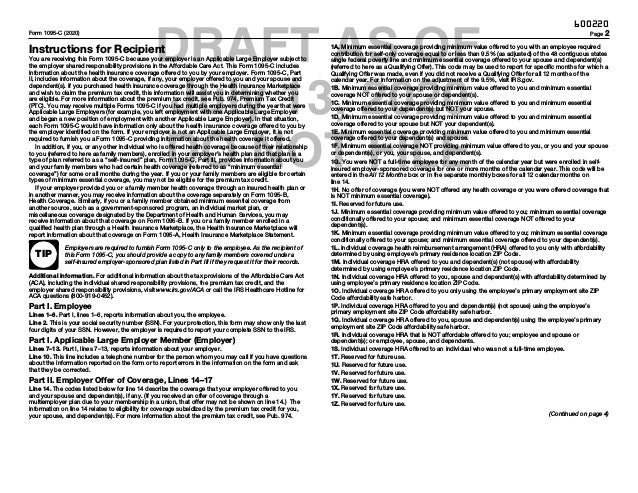

Your 1095C Tax Form for You will soon receive your 1095C via US Mail for the tax year containing important information about your health care coverage Employers are required to provide the 1095C to the following employees as part Form 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing forms with the IRS and furnishing statements to individuals Filing With IRS ALEs must file the 19 Form 1094C transmittal (and copies of related Forms 1095C) with the IRS by , if they are filing on paper ALEs filing When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 and 16 of Form 1095C

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Form 1095A, 1095B, 1095C, and Instructions The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage, so individuals won't have to fill them out themselvesForm 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage Use the information contained in the 1095C to assist you in determining in you are eligible for the premium tax creditIn Part II of Form 1095C, for , the employer is required to input the age of the employee as of January 1st for any employee offered an ICHRA Further, on Line 14, Codes 1L through 1S have been introduced to capture offers of coverage for ICHRAs

/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

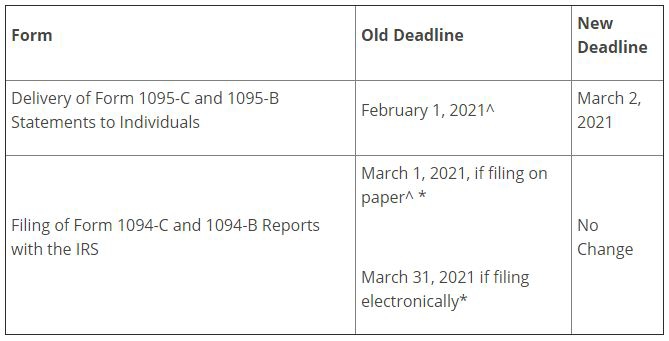

There were quite a few changes this year, including an extended print & mail deadline, so please read carefully Extended Print & Mail Deadline March 2nd, 21 Updated 1095C Employer Reporting Guide The IRS recently provided the final 1095C employer reporting forms and instructions The 1095C forms were modified slightly, primarily to facilitate reporting by employers who offered individual coverage HRAs (ICHRAs) in The Form 1094Cs are pretty much identical to last yearIRS Form 1095C is filed with the IRS by the applicable large employer (ALE) who offers health coverage and enrollment in health coverage for their employees Employers with 50 or more full time employees are considered ALEs Employers use 1095C Form to report the information required under section 6056

1095 C Faqs Office Of The Comptroller

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

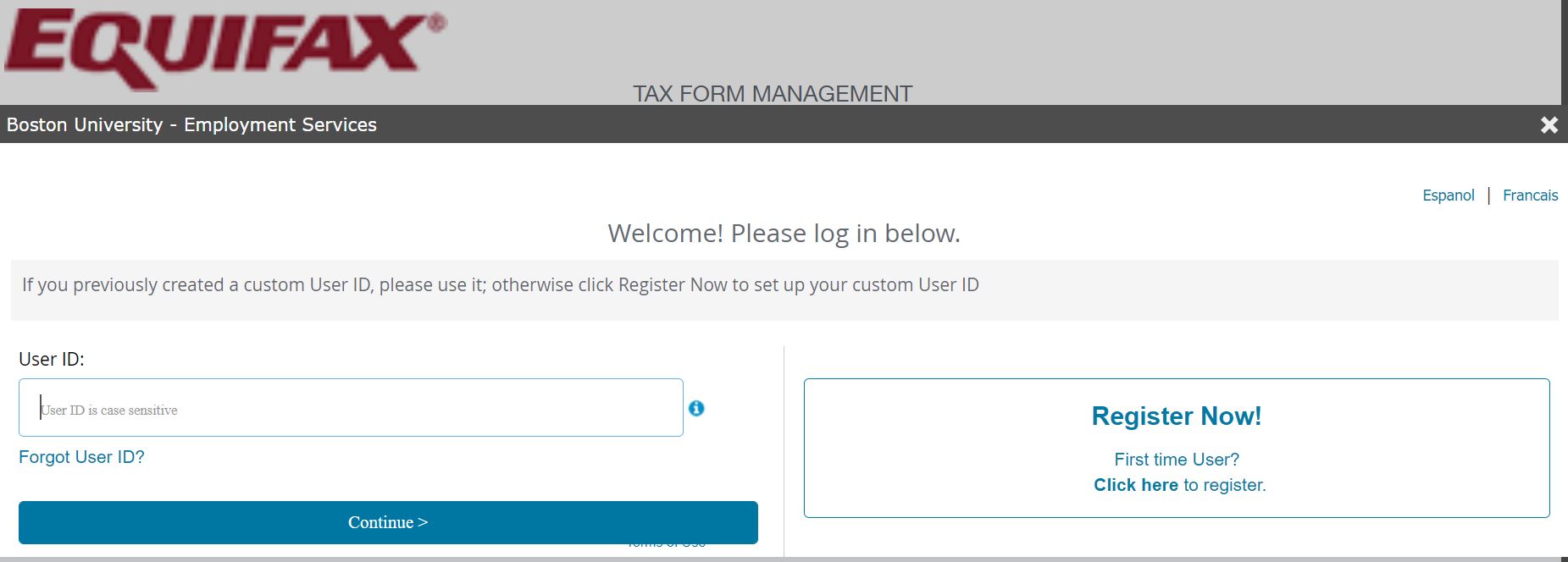

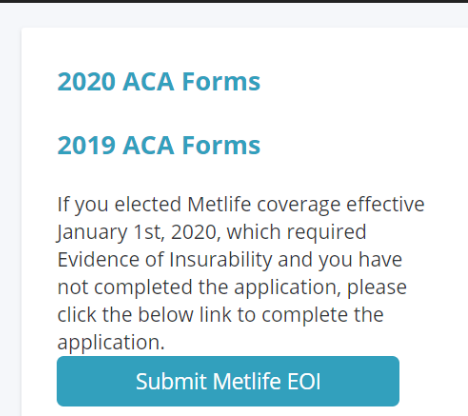

1095C Form Download ACAPrime Save a Tree – Send your 1095C via Email to your Employees!Form 1095C's for the University of Pittsburgh employees for the tax year are to be mailed in January 21 If you believe you should have received a Form 1095C but did not, please contact the University of Pittsburgh's Benefits DepartmentMembers on an ASO/SelfInsured Commercial Health Plan receive Form 1095C from their Employer You do not have to wait for either Form 1095B or 1095C from your coverage provider or employer to file your individual income tax return You can use other forms of documentation, in lieu of the Form 1095 information returns to prepare your tax return

Aca Reporting Faq

Irs Form 1095 C Codes Explained Integrity Data

Minimum essential coverage not offered to dependent(s) (See Conditional offer of spousal coverage, for anThe due date for furnishing Form 1095C to individuals is extended from , to See Notice 76 and Extensions of time to furnish statements to recipients Relief for failure to furnish statements to certain employees enrolled in selfinsured health planForm 1095C Line by Line Instructions Updated on 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updated

Irs 1095 C 21 Fill Out Tax Template Online Us Legal Forms

1

On , the Internal Revenue Service (IRS) announced an extension of the due date to furnish health coverage information forms to employees in Notice 76 Applicable Large Employers (ALEs) now have until March 2, On the IRS finally released its draft instructions for the Forms 1094C and 1095C While we knew substantial changes were coming to the instructions as a result of Individual Coverage HRAs (ICHRAs), the IRS also made changes that will impact every employer required to file the Forms As a result of most employers not offering ICHRAs and for simplicitySample Form 1095C ACA 1094/1095 Reporting Requirements for 6 Guidance for Applicable Large Employers NOTE This guidance applies to Applicable Large Employers ACA 1094/1095 Reporting Requirements for 7 Coding Tips for 1095 Filings NAHU, the National Association of Health Underwriters,

Www1 Nyc Gov Assets Olr Downloads Pdf Health 1095 C Form Pdf

Form 1095 C Guide For Employees Contact Us

Form 1095C FAQ's Reporting Year The Affordable Care Act requires that large employers provide each fulltime, benefitseligible employee receiving health insurance benefits, a 1095C report This report provides details of employee's enrollment in medical coverageWhat is IRS Form 1095C? IRS released drafts of Form 1094C and 1095C for ALE Status Calculator Use this calculator to determine your ALE status Letter 5699 A helpful resource for the employer about letter 5699 Letter 226J Helpful resource on Letter 226J (ESRP) Blog Stay updated with the latest information

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

Irs Extends Deadline For Furnishing Form 1095 C Extends Good Faith Transition Relief Fedeli Group

Affordable Care Act, stay in ACA compliance Software to format and print or efile 1095C and 1094C forms Enter ACA tracked data (offers of coverage, covered individuals or premiums paid) directly in digital forms or upload using Excel templateEmployers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their recordsForms and Publications (PDF) Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Instructions for Forms 1094B and 1095B

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Form 1095C is sent out to those who enrolled in a health plan through the Health Insurance Marketplace In 21, you will be furnished with a Form 1095C reporting the information you need to know about the plan you enrolled inCODES FOR IRS FORM 1095C CODE SERIES 1 (continued) 1J Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage conditionally offered to spouse; Other Recent Form 1095C Changes to Filing Instructions In , the IRS introduced a handful of other changes to ACA reporting forms These included Plan Start Month All Applicable Large Employers (ALEs) must enter a twodigit code on Form 1095C

Aca Forms

Districtwide Notice Regarding Corrected Form 1095 C Currents

According to the IRS, as long as an employer obtains prior consent (electronically), the employer can distribute forms 1095C to employees through email or NonICHRA changes include making completion of the Plan Start Month box mandatory on Form 1095C for the first time The Form 1095C instructions note that the Code § 4980H (b) affordability threshold for plan years beginning inFilling out Form 1095C 2D The EE was in a Limited Nonassessment Period (LNAP) for the month 2E You are eligible for the multiemployer interim relief rule 2F The coverage you offered is affordable based on the Form W2 Safe Harbor 2G The coverage you offered is affordable based on the Federal Poverty Line safe harbor

Changes Coming For 1095 C Form Tango Health Tango Health

Irs Provides Aca Reporting Relief For Compliance Guidance

Thus, a 1095C form will be sent in early January 21 The IRS expects every ALE to send in a completed 1095C printable form for each eligible employee by the end of February If they choose to fill out the statement electronically, the IRS allows them to submit a 1095C online form until the end of March On Oct 2, , the IRS announced it would extend the deadline for employers to provide employees with a copy of their 1095C or 1095B reporting form, as required by the ACA, from Jan 31, 21Cat No M Form 1095C () Form 1095C () Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 C Template Fill Online Printable Fillable Blank Pdffiller

The latest extension, detailed in IRS Notice 76, gives insurers and employers until , to distribute Forms 1095B and 1095C to plan members and employees Forms 1095A (from the exchanges) for coverage still had to be sent to enrollees byInst 1094B and 1095B Instructions for Forms 1094B and 1095B Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094C and 1095CForm 1095C is the EmployerProvided Health Insurance Offer and Coverage Form 1095C is designed by the IRS to capture enough information about the employer

Irs Form 1095 C Fauquier County Va

Irs Form 1095 C Download Fillable Pdf Or Fill Online Employer Provided Health Insurance Offer And Coverage Templateroller

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs Announces Limited Relief For Information Reporting On Forms 1094 1095

Your 1095 C Tax Form My Com

Topic 4 1095 C Tax Form Gwell

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

The 19 Aca Reporting Is Due In Early Final Forms And Instructions Released Narfa

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Annual Health Care Coverage Statements

1

Integrity Data The Irs Has Extended The Deadline For Distributing Form 1095 C To Employees From January 31 To March 2 Get All The Details From The Irs Here

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

3

Form 1095 A 1095 B 1095 C And Instructions

What Are The Form 1094 C And 1095 C Requirements For Self Insured Health Plans In

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Your 1095 C Tax Form For Human Resources

Irs Form 1095 C The Best Way To Fill It Out Wondershare Pdfelement

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

Irs 1095 Forms And Instructions Fill Pdf Online Download Print Templateroller

Employer Aca Reporting Final Forms Lawley Insurance

Instructions For Forms 1095 C Taxbandits Youtube

Form 1095 A 1095 B 1095 C And Instructions

1095 C Form Official Irs Version Discount Tax Forms

1094 C Irs Transmittal For 1095 C Forms For 5500 Tf5500

1

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Changes Coming For 1095 C Form Tango Health Tango Health

1095 C Sample Hcm 401 K Human Resources

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

The New 1095 C Codes For Explained

Form 1095 C Forms Human Resources Vanderbilt University

1095 C Tax Form For Gwell

Irs 1095 C Draft Form

Form 1095 C Printable Get 1095c Form To Print Healthcare Marketplace Tax Form Fillable With Instructions

Form 1095 C Instructions For Employers Furnishing Filing

Form 1095 C Mailed On March 1 21 News Illinois State

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

Irs Health Coverage Reporting Form 1095 C Examples For Youtube

Your 1095 C Tax Form For Human Resources

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

1095 C Form 21 Finance Zrivo

Affordable Care Act Deadlines Extended For Notices Lexology

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 C Forms Human Resources Vanderbilt University

Irs 1095 C Draft Form

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Irs 1095 C Draft Form

Form 1095 C Released New Codes New Deadlines

Benefits Vmware Com Wp Content Uploads 21 01 Form 1095c Faq 21 Pdf

W H A T I S 1 0 9 5 C F O R M F O R Zonealarm Results

Irs Mailing Deadline February 28 Aca Gps

Hr Jhu Edu Wp Content Uploads 19 06 Aca 1095faq Pdf

1095 C Preprinted Portrait Version With Instructions On Back

Changes Coming For 1095 C Form Tango Health Tango Health

Irs Releases Forms 1094 1095 And Related Instructions Including New Rules For Ichra Reporting

7 Questions Employees Are Asking In About Aca 1095 Cs United Agencies Inc

What Is An Irs Form 1095 C Boomtax

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Affordable Care Act Setup

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Irs Extends Deadline For Furnishing Form 1095 C To Employees Extends Good Faith Transition Relief For The Final Time Hmk

Ez1095 Software Is Now Available With Efile Capability For Affordable Care Act Aca Forms 1095

Www Northwestern Edu Hr Documents Benefits 1095 Faq Pdf

1095 C Envelope Printing Selection Criteria For The Use Of A W 2 Style Envelope Integrity Data

Irs Form 1095 C Uva Hr

Form 1095 C Now Available Online At My Vu Benefits News Vanderbilt University

Aca Forms

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

1095 C Faqs Mass Gov

Irs Extends Deadline For Furnishing Form 1095 C To Employees Woodruff Sawyer

What You Need To Know About Aca Annual Reporting Aps Payroll

0 件のコメント:

コメントを投稿