A list of job recommendations for the search independent contractor 1099 forms irsis provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggested Make sure the contractor checks the box exempting him from tax withholding As a separate business entity, the IC should file his or her own selfemployment taxes Zenefits preps and stores this document for companies that hire and pay contractors through the platform Form 1099 Sole proprietors and independent contractors are selfemployed and are eligible for several of the small business relief programs The Paycheck Protection Program is a loan program to help businesses pay for emergency needs, including paying employees A Sick Leave and Medical Leave tax credit is also available to selfemployed business owners who must take

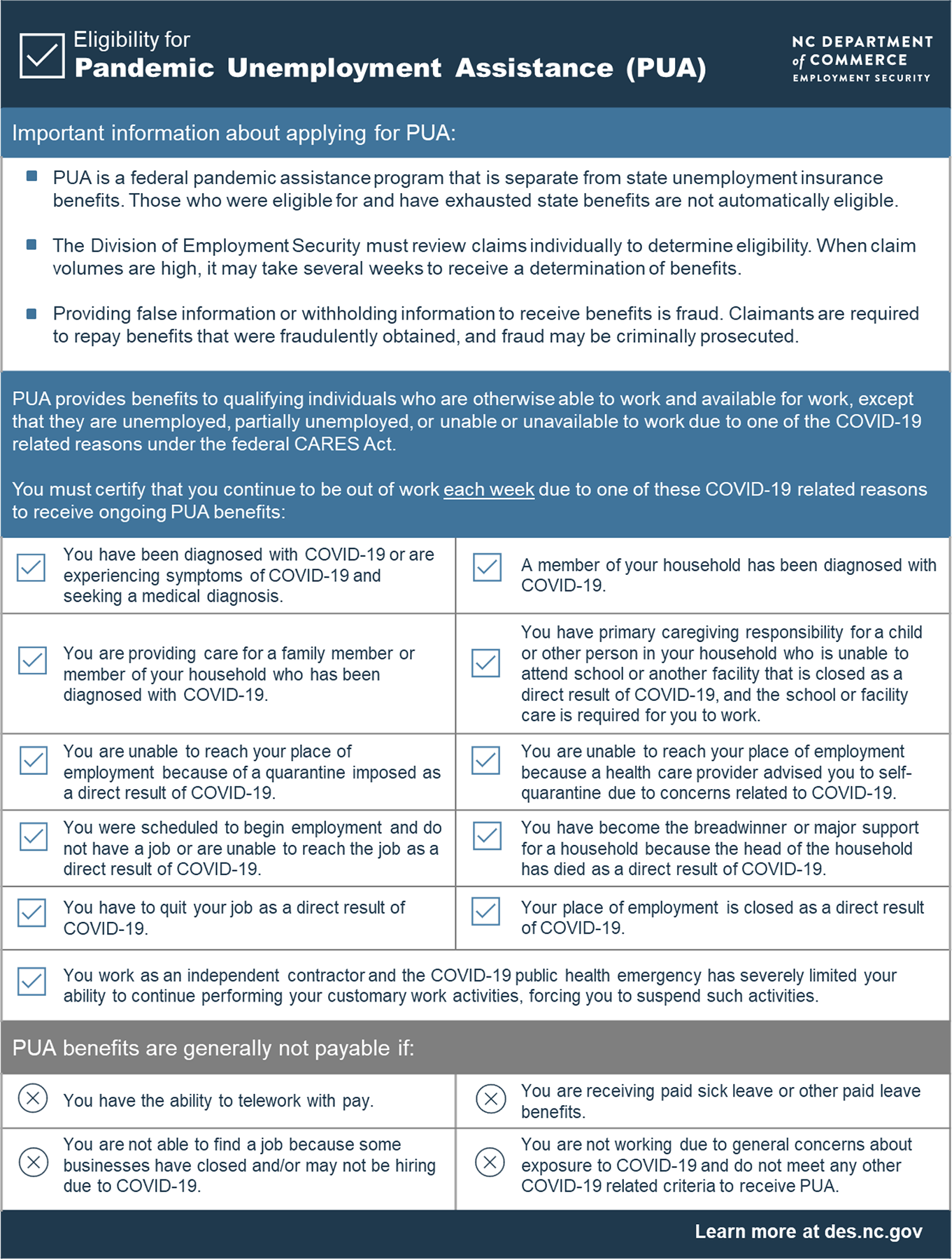

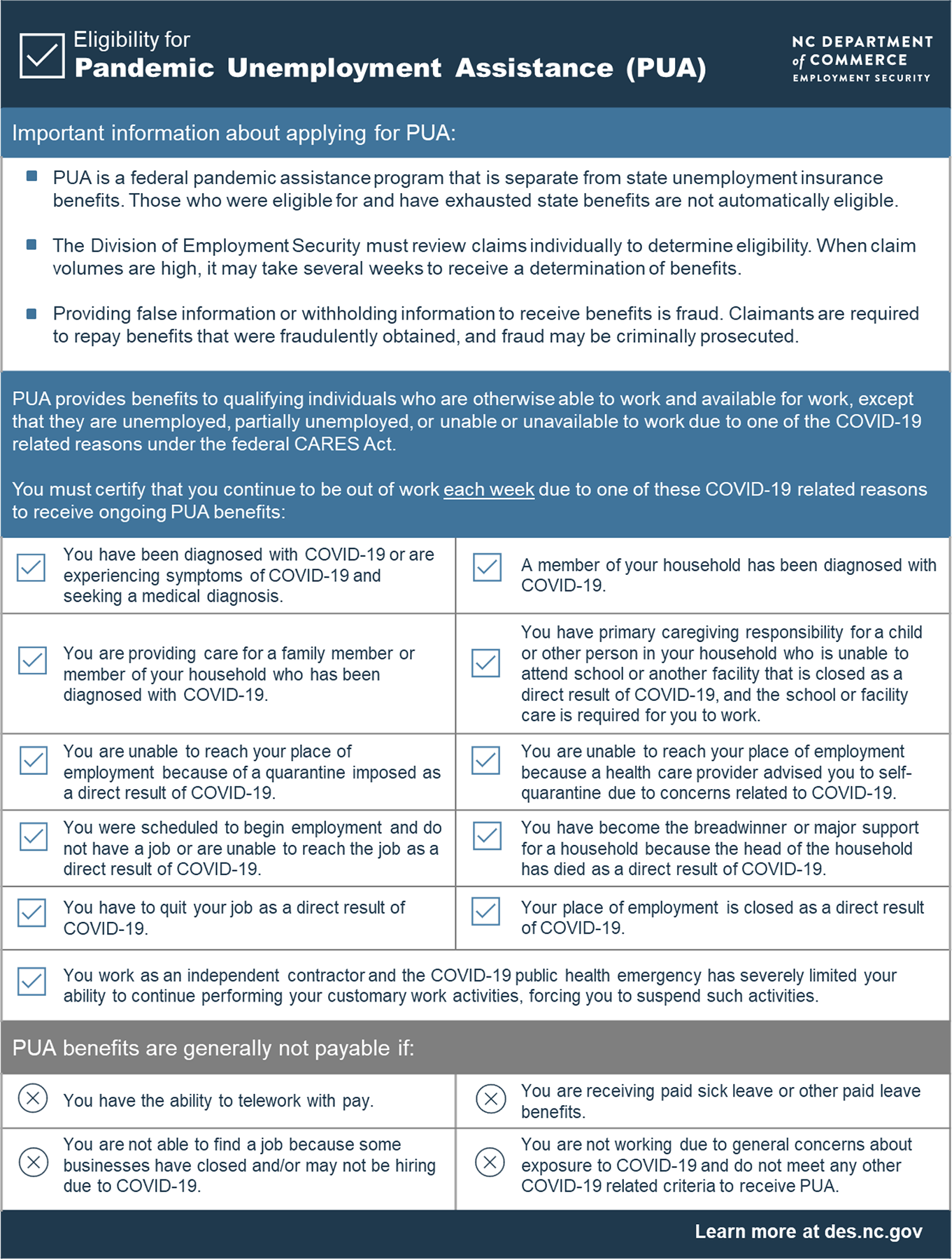

Des Pandemic Unemployment Assistance

Do independent contractors get a 1099

Do independent contractors get a 1099- Form entitled "SSI Recipient – Final Report re SelfEmployment" This is the form you use when you finish a period of selfemployment – for instance, if you have been working as an independent contractor or consultant under a contract that has expired or run out of timeHere, I walk you through applying for the Paycheck Protection Program (PPP) based on your gross income using Womply and their Fast Track application process

1099 Misc Tax Form Diy Guide Zipbooks

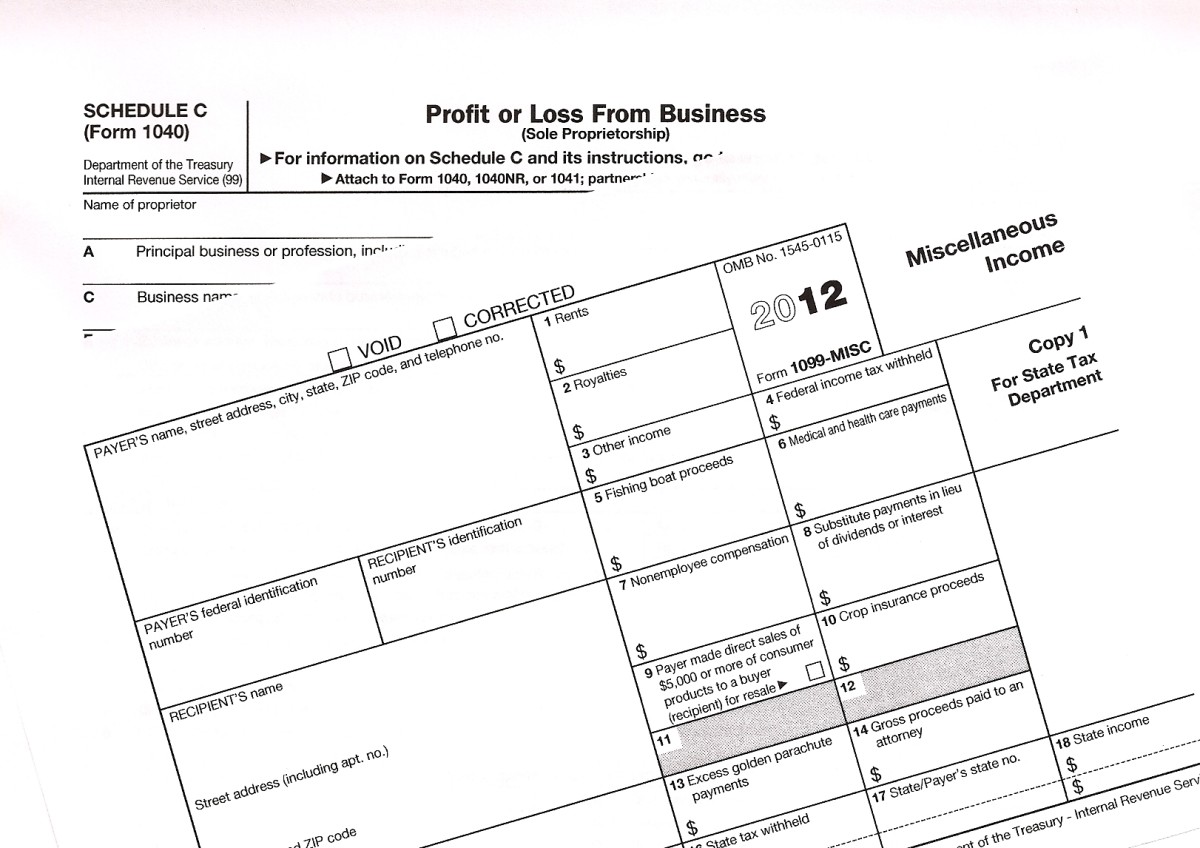

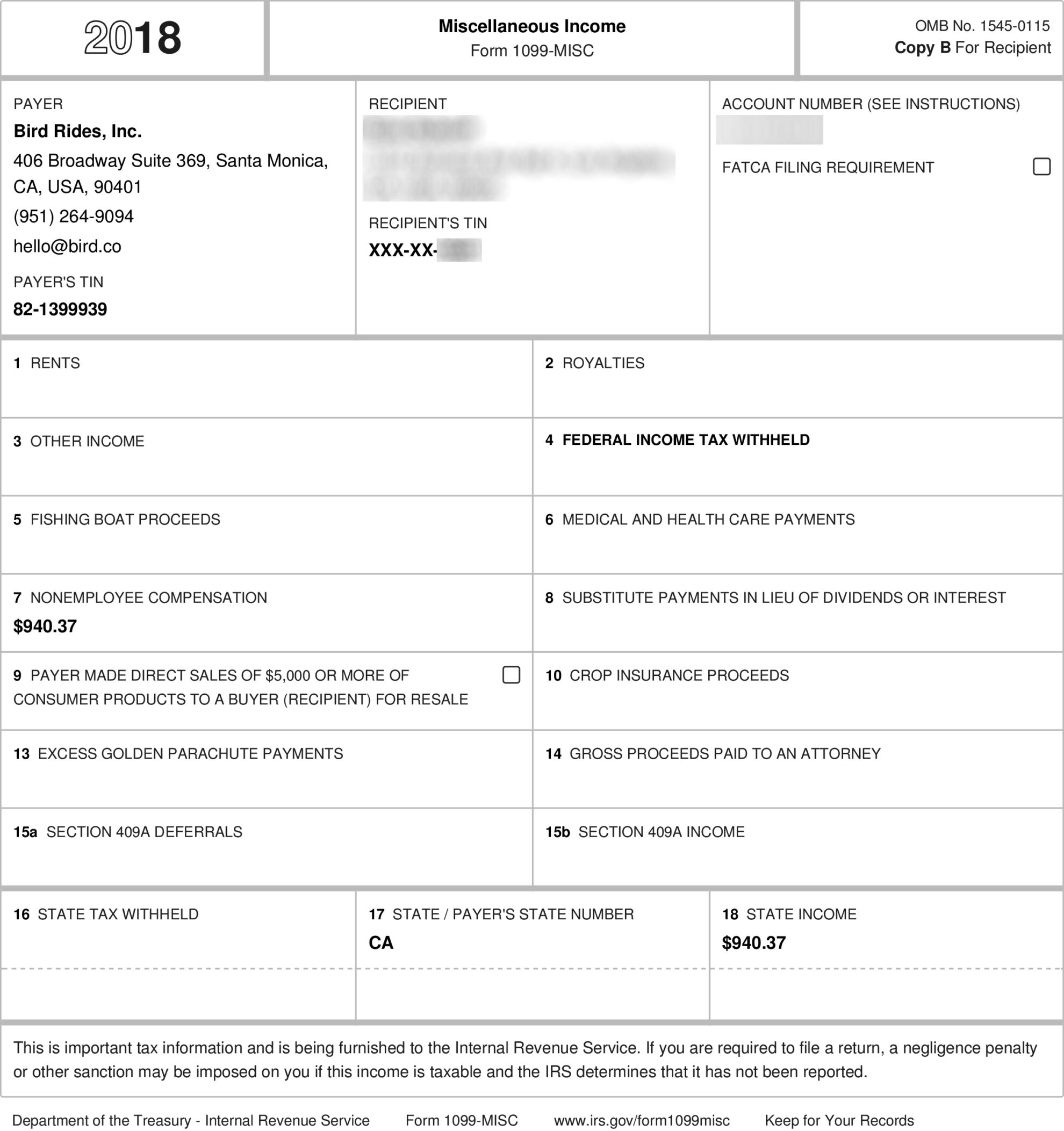

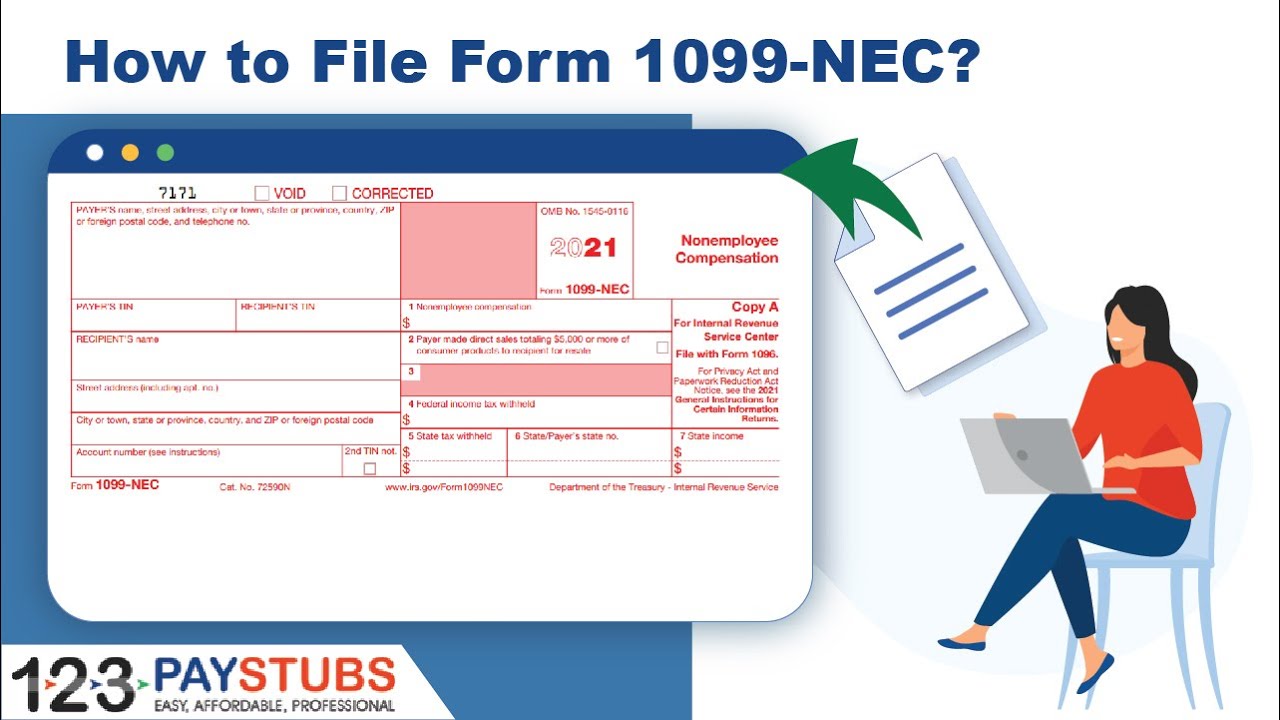

Form 1099 Step by Step Instructions on how to efile the Form 1099 is Taxable Income on your or 21 Tax Return May 17 is Due Date Form 1099 Reported Online to the IRS by the Payer or Issuer Issue a Form 1099 to a Payee, Contractor or the IRS How contractors use Form 1099NEC Most freelancers and independent contractors use Schedule C, Profit or Loss From Business, to report selfemployment income on their personal tax returns Here is the process for reporting income earned on a Form 1099NECIndependent contractors (often called 1099 contractors in the US) are people who offer their professional services to clients They are usually selfemployed owners of small businesses that you hire for a fixed period of time or on a project basis Every country has its own regulations that define their independence

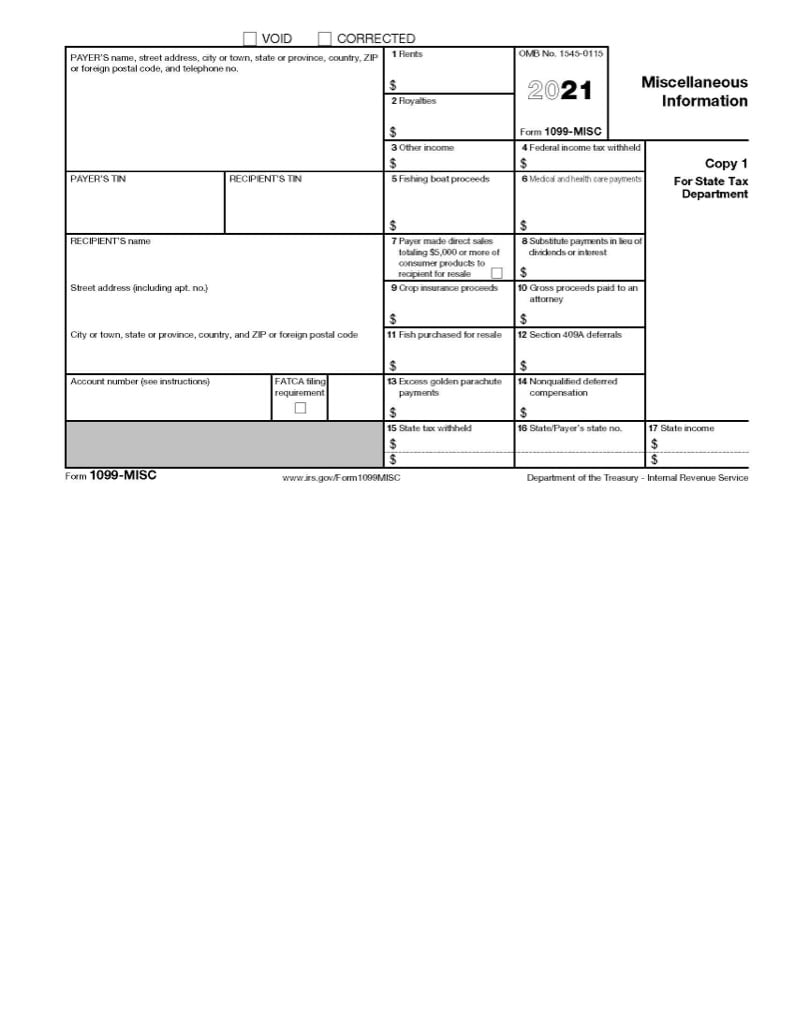

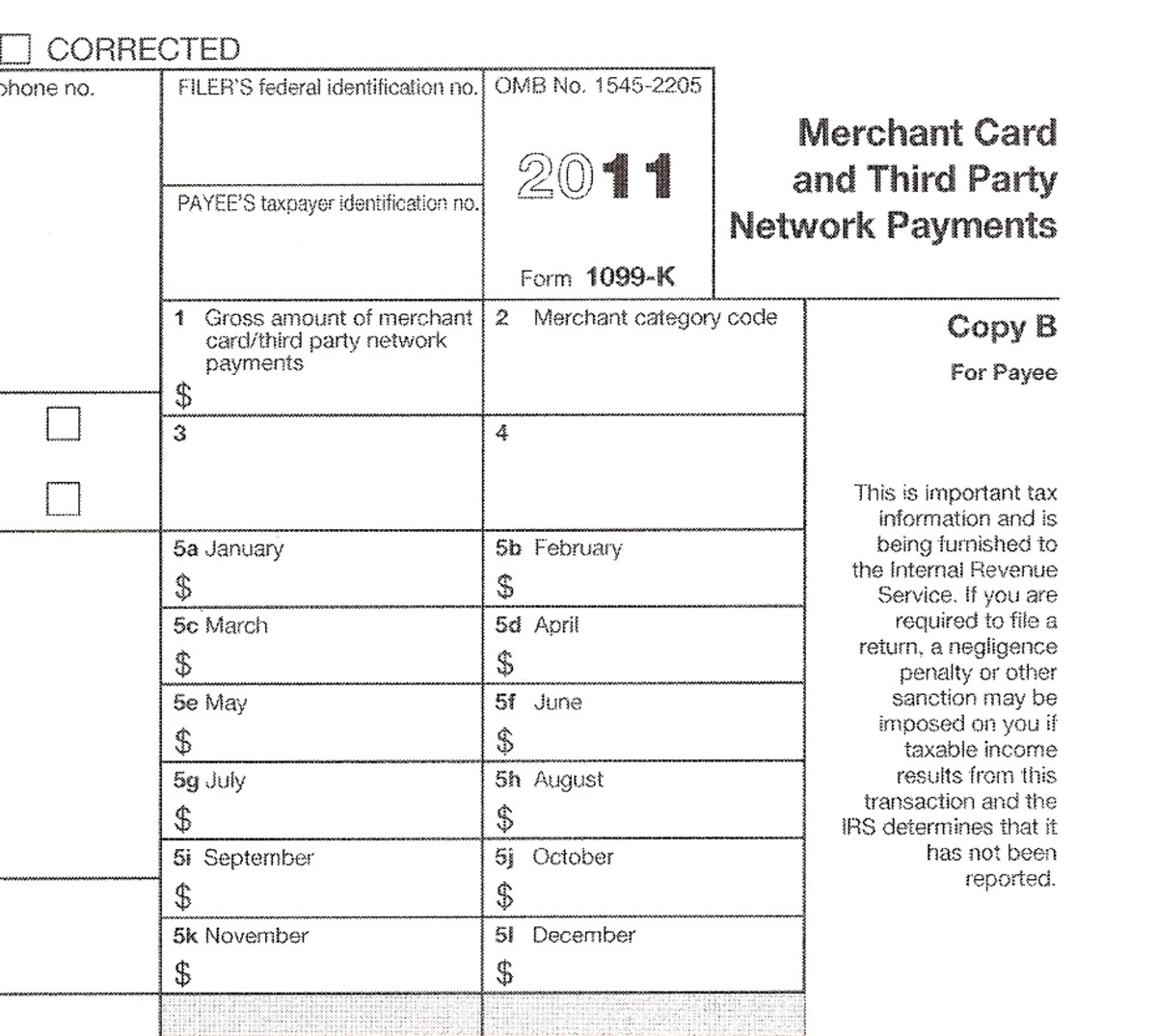

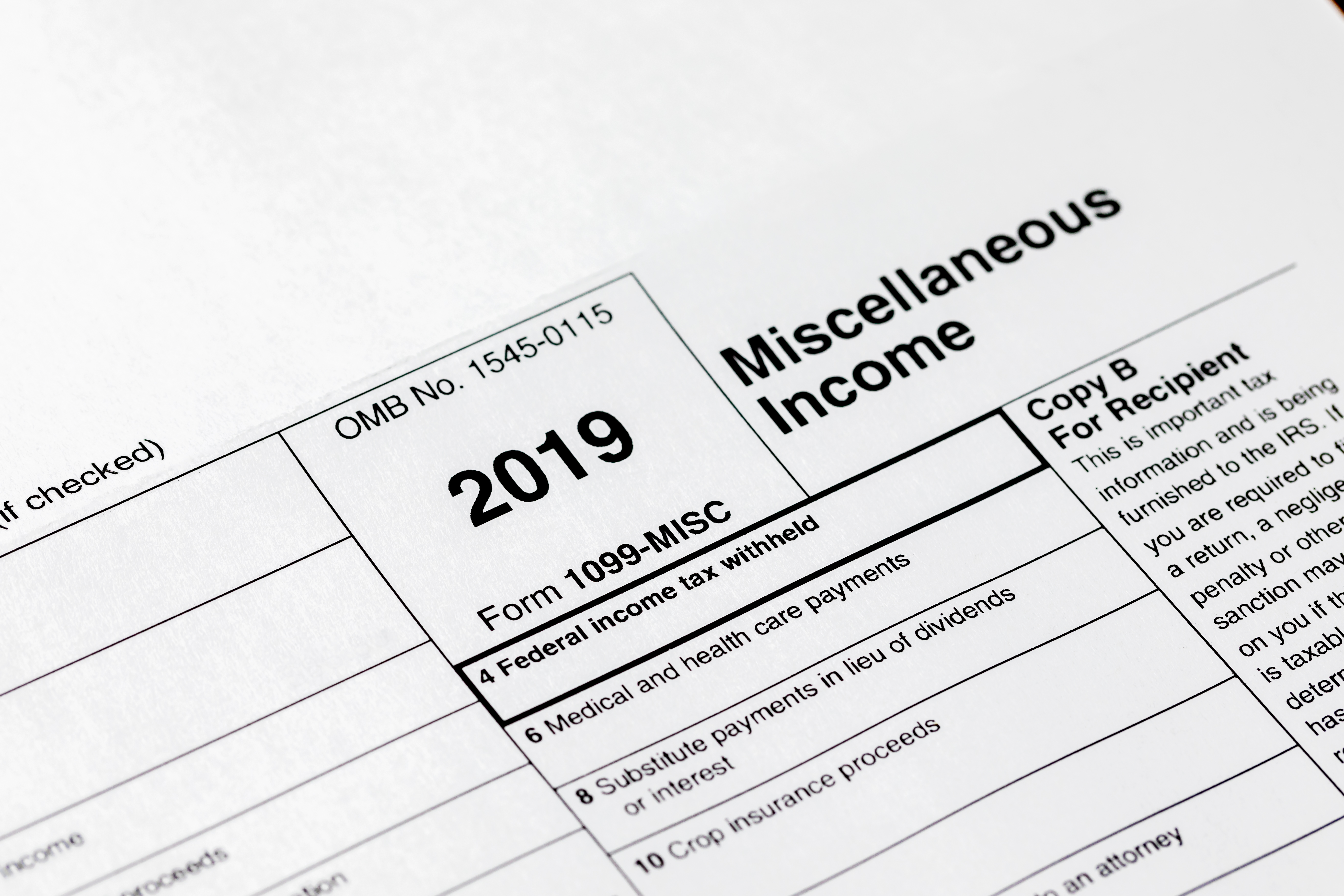

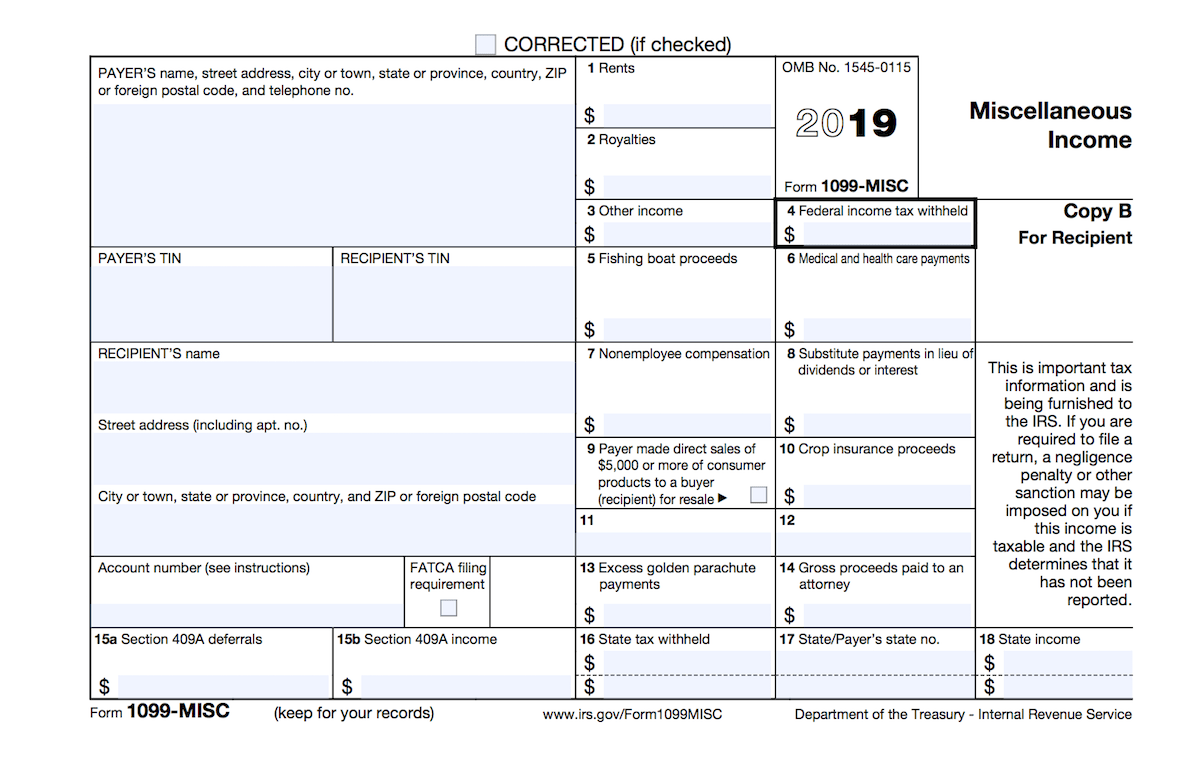

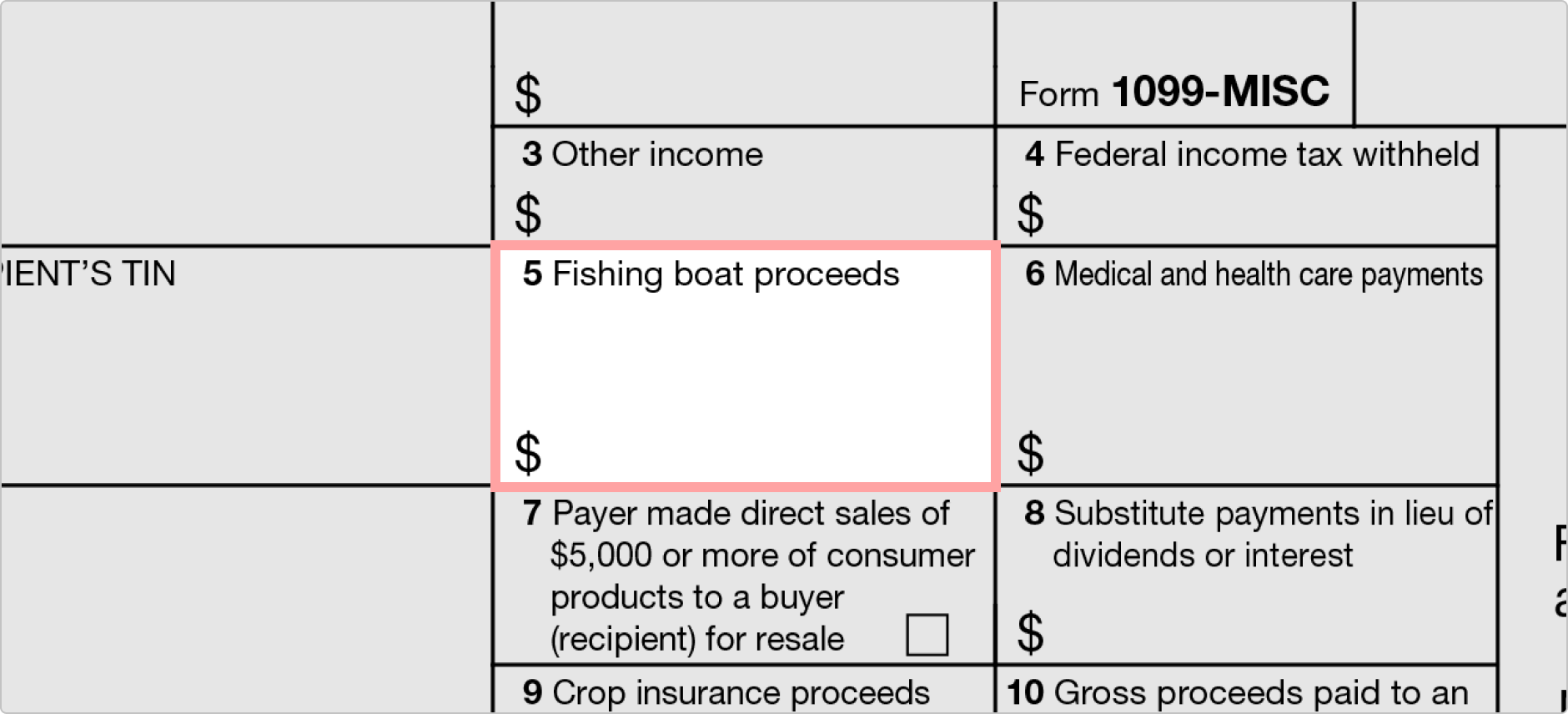

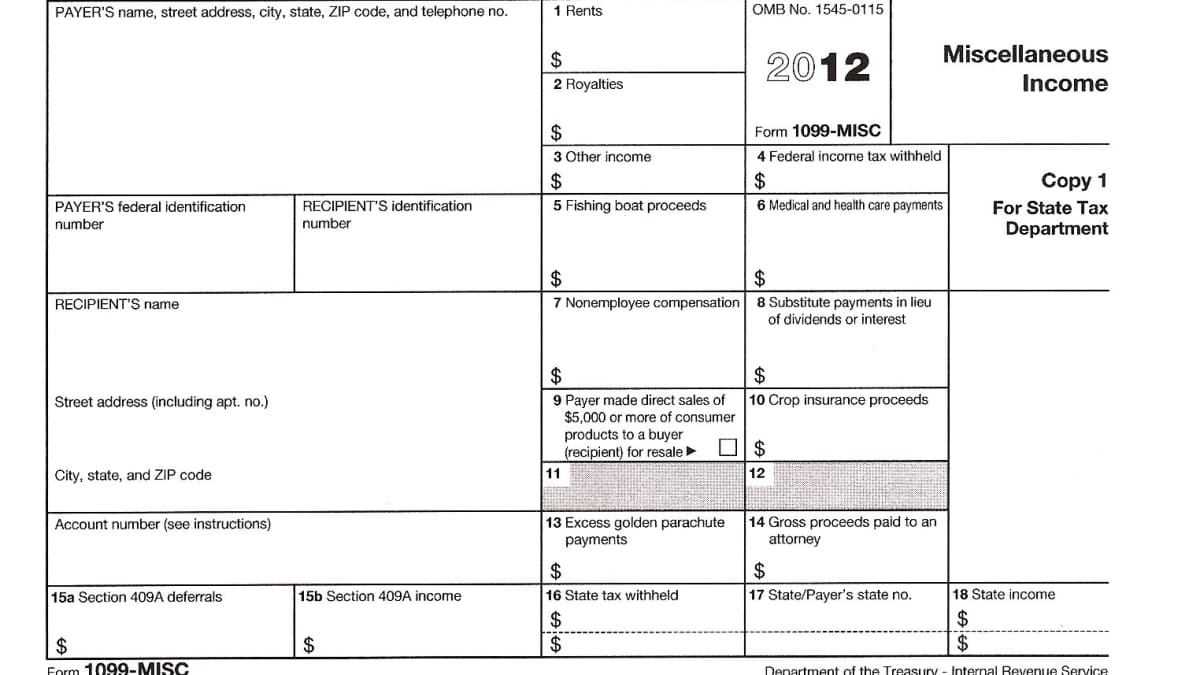

If payment for services you provided is listed on Form 1099NEC, Nonemployee Compensation, the payer is treating you as a selfemployed worker, also referred to as an independent contractor You don't necessarily have to have a business for payments for your services to be reported on Form 1099NEC You may simply perform services as a nonemployee Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC)As an independent contractor, you may receive a 1099K or form 1099MISC, you'll want to make sure you have those on hand You may also have W2 income, interest or dividend statements and you'll need all of that information ready for you in one place once it's time to prepare your taxes Organize your records

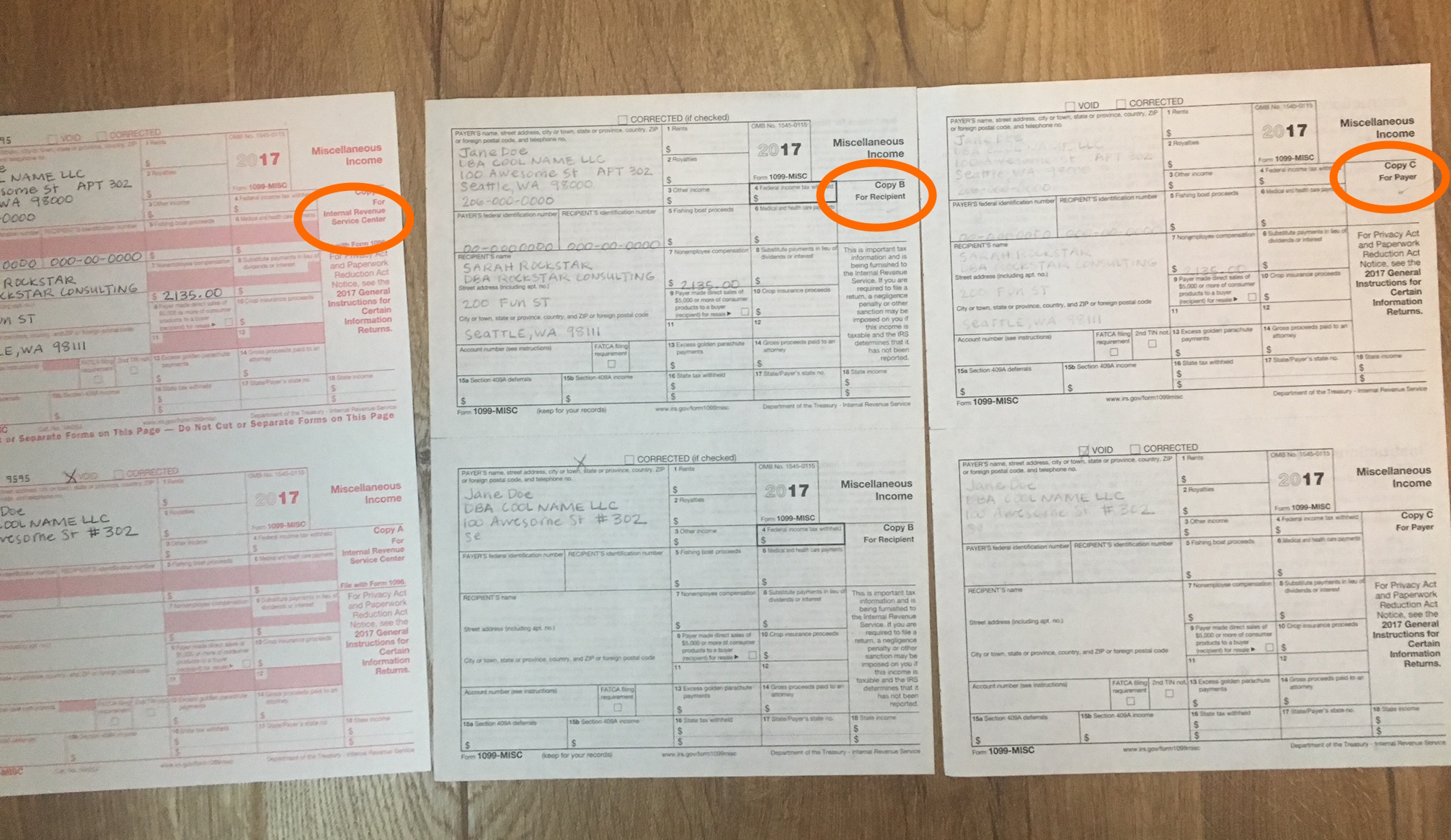

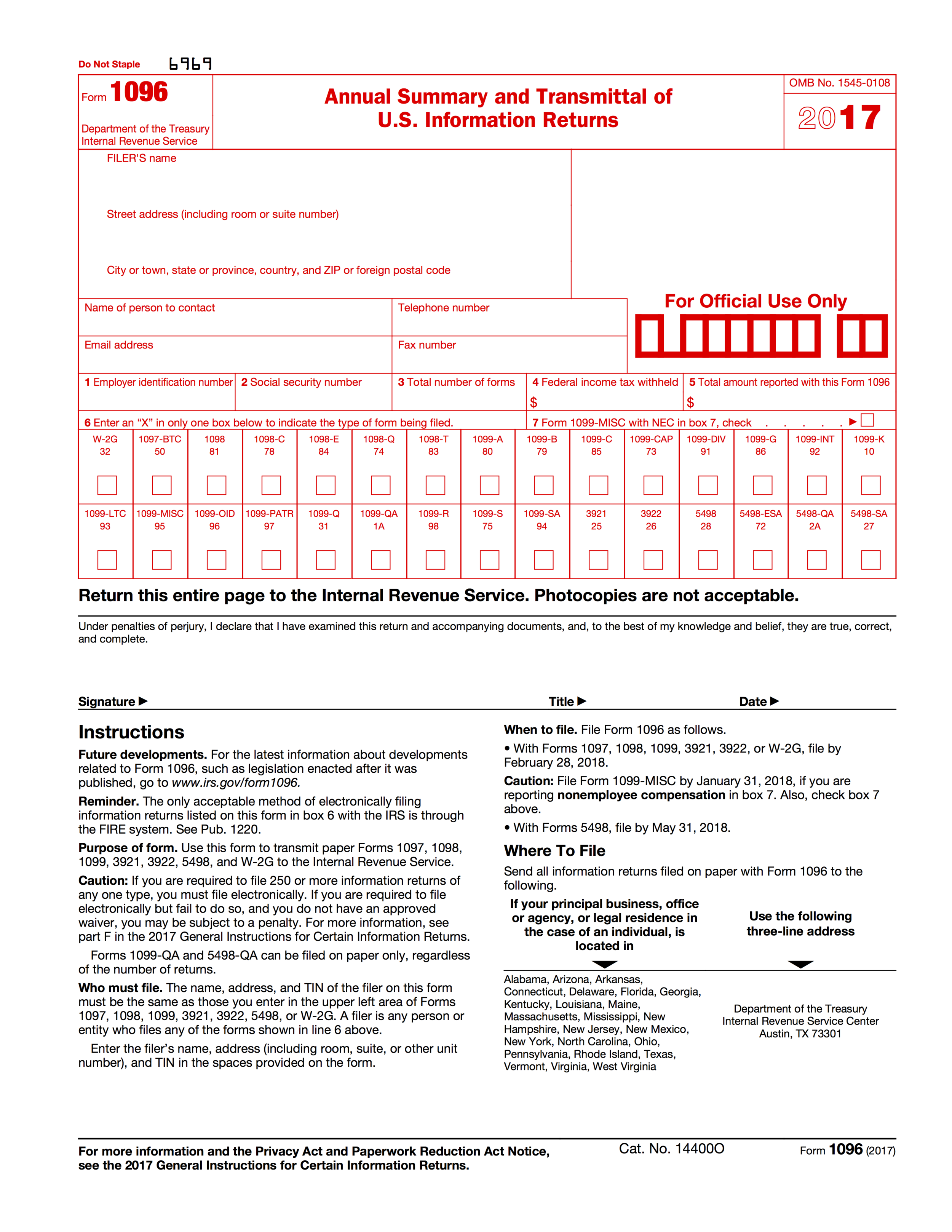

Once you know which contractors you paid over $600 to, you will need to fill out Form 1099NEC Starting at the upper left box, record your organization's name as the PAYER The PAYER TIN is the organization's tax identification number The RECIPIENT'S TIN is the contractor's SSN or business TINYou made $400 in selfemployed/1099 income For the full details, check out the IRS's clarification "Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed" While the annual return is due on Tax Day (April 15th), quarterly taxIt's another story for freelancers and independent contractors who have their income reported on Forms 1099 If you are earning Form 1099 income you need to know your income tax bracket because you do not have the benefit of employer withholding and must send estimated tax payments to the IRS each quarter

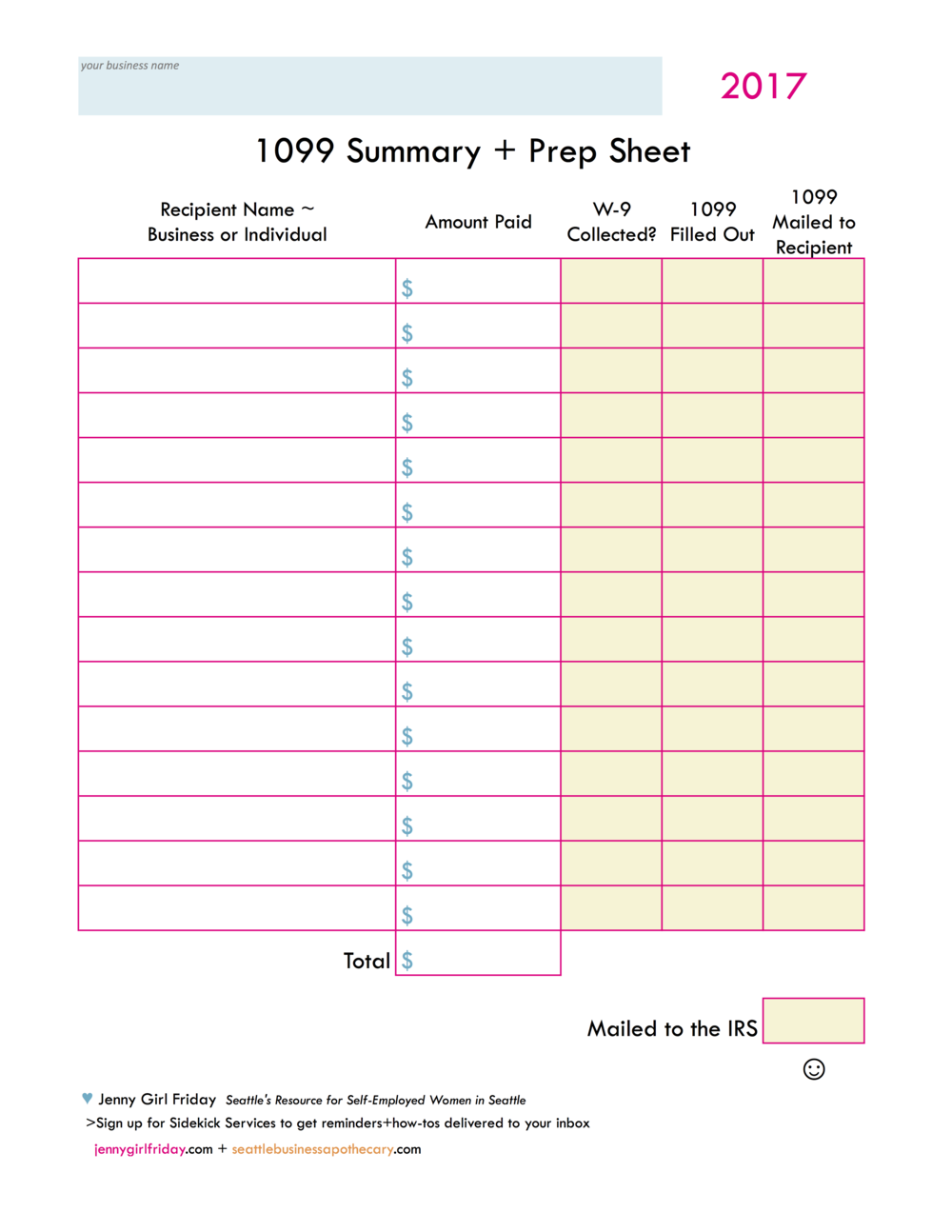

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

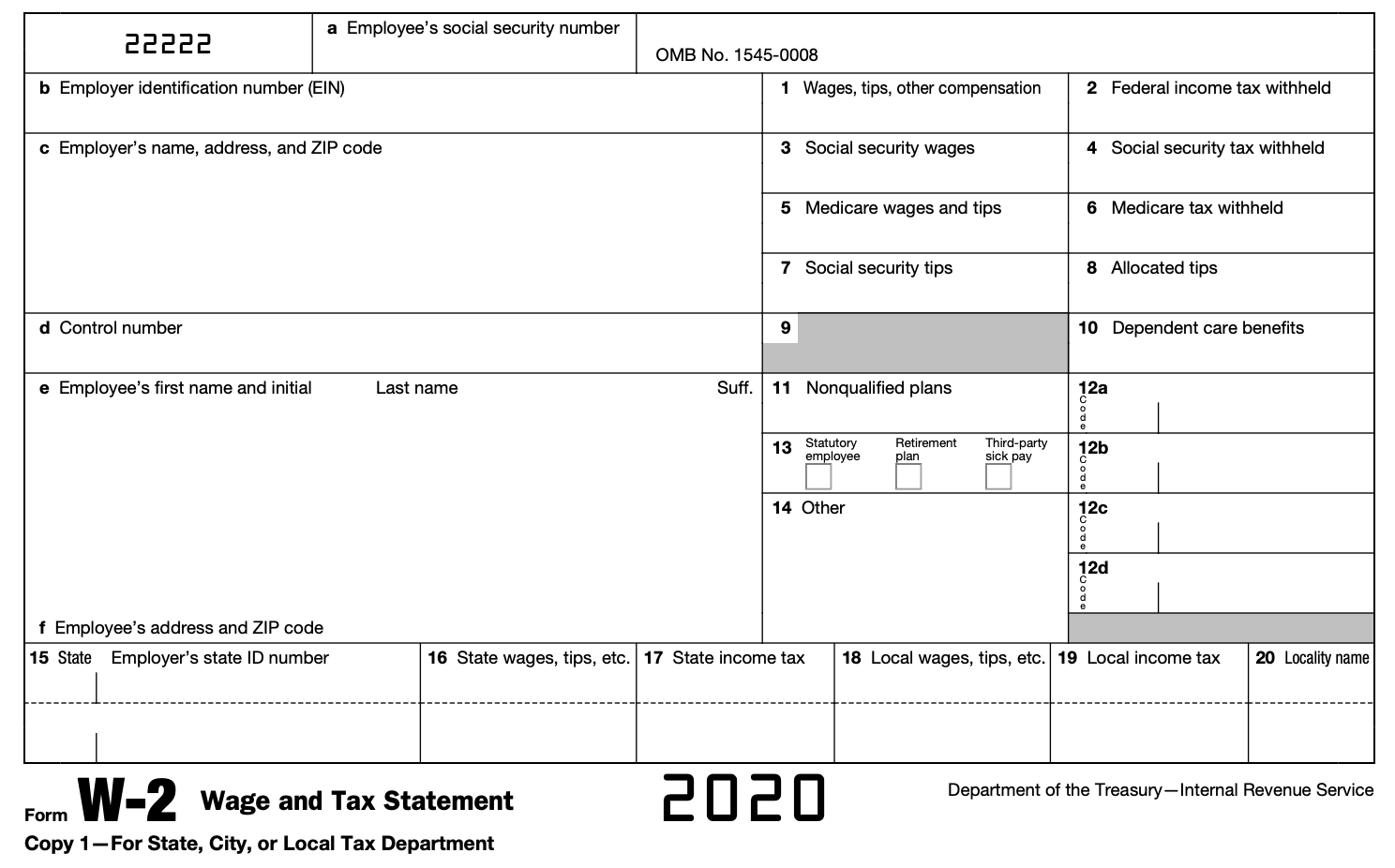

Independent Contractor and Statutory Employee You might be both an independent contractor and employee at the same time As a statutory employee, you will receive periodic paychecks and, for each tax year, a W2 from your employer(s) by January 31 of the following year If you also have independent contract income, that might be reported via one or more 1099 forms Selfemployed or independent contractor?As an independent contractor or selfemployed individual, you should report your income on Schedule C (Form 1040) Per the IRS Instructions for Schedule C, page C1 Use Schedule C (Form 1040 or 1040SR) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor

Need To Know Covid 19 Unemployment Benefits For The Self Employed News At Poole College

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

A list of job recommendations for the search independent contractor irs form 1099 is provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggestedSince your income was reported to you on a Form 1099MISC, the company has treated you as an independent contractor and your income is treated as selfemployment income 1099NEC is the version of Form 1099 you use to tell the Internal Revenue Service whenever you've paid an independent contractor (or other selfemployed person) $600 or more in compensation (That's $600 or more over the course of the entire year)

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Self Employed

If you paid any Independent Contractors more than $600 in one year, for service work, you need to submit a 1099MISC form (1099 for short)both to the Recipient and to the IRS To read more, click here Time Required 5 10 minutes per form (more time if In this article, we will consider how to generate a paystub for 1099 independent contractors Let's get started!Tax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

1099 Misc Form What Is It And Do You Need To File It

Get a solid understanding of freelancers, temporary employees and independent contractors from our employee classification experts The 411 on 1099 formsI received a Form 1099MISC from a company that paid all employees this way Will my income go on line 21 of Form 1040 as Other Income or on Schedule C? If payment for services you provided is listed on Form 1099NEC, Nonemployee Compensation, the payer is treating you as a selfemployed worker, also referred to as an independent contractor You don't necessarily have to have a business for payments for your services to be reported on Form 1099NEC You may simply perform services as a nonemployee

3

Des Pandemic Unemployment Assistance

(en español) Benefits available for selfemployed workers Unemployment benefits are available for Washingtonians who have lost work because of the COVID19 crisis—including freelancers, independent contractors and other selfemployed workers Federal CARES Act extensions make this possiblePaying Taxes On Your SelfEmployment Income The biggest reason why filing a 1099MISC can catch people off guard is because of the 153% selfemployment tax The 1099 tax rate consists of two parts 124% for social security tax and 29% for Medicare The selfemployment tax applies evenly to everyone, regardless of your income bracket If you are selfemployed, you can start with Form 1040ES (Estimated Tax for Individuals), and then file the other necessary forms with your 1040 Form during the tax season If you need help with a 1099 contractor needing a business license, you can post your job on UpCounsel's marketplace UpCounsel accepts only the top 5 percent of lawyers to

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Employees Everything Employers Should Know Vensurehr Blog

1099 Independent Contractor The IRS classifies many self employed workers as independent contractors These are individuals who don't necessarily have a full operation going, but more so a one man show, like a freelance graphic designer or writer Independent Contractor Income compensation you receive for doing work or providing services as a selfemployed individual, not as an employee If you are selfemployed and an independent contractor, your compensation is reported on Form 1099MISC or Form 1099NEC (along with rents, royalties, and other types of income)Independent contractor income If you are a worker earning a salary or wage, your employer reports your annual earnings at yearend on Form W2However, if you are an independent contractor or selfemployed you should receive a Form 1099NEC (1099MISC in prior years) from each business client that pays you at least $600 during the tax year For example, if you

Major Changes To File Form 1099 Misc Box 7 In

Salaried Employees Vs Independent Sales Reps Which Is Best For Your Global Enterprise Express Global Employment

Since an independent contractor doesn't receive a W2 form for paying taxes, they will receive a 1099 form, which shows no tax deductions This is because they are responsible for paying their own selfemployment tax like Medicare and Social Security, in addition to personal income tax Independent contractors must report their Form 1099 income on Schedule C (Form 1040 or 1040SR), Profit or Loss from Business (Sole Proprietorship) Additionally, if their business income or net earnings from selfemployment total $400 or more during the tax year, he or she must also file a Schedule SE (Form 1040 or 1040SR), SelfEmployment TaxBusiness & Self Employed EINs and other information Government Entities Filing For Individuals

Buy Intuit Turbotax Home Business 18 Tax Preparation Software Online In Taiwan B07tywjckk

Www Taylorbank Com Link 4ecaed6eb2b34d4bd Aspx

An independent contractor is selfemployed and receives 1099 forms from each client they did work for during the year An independent contractor fills out a W9 for their client For a sole proprietor, these 1099 forms (along with all the business expenses) flow onto Schedule C and then on to the 1040A list of job recommendations for the search irs 1099 independent contractor formis provided here All of the job seeking, job questions and jobrelated problems can be solved Additionally, similar jobs can be suggestedThe number of selfemployed people in the United States is rapidly increasing, and it's not surprising at all

What Is The Difference Between Form 1099 Misc Vs Nec Taxbandits Youtube

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

Workers operating as independent contractors need to provide their own benefits and cover their expenses For tax purposes, the key thing to understand is the form that you receive If you are paid as an independent contractor, you will receive a Form 1099MISC, while if you are paid as an employee, you will receive a W2 form19 IRS Form W3If payment for services you provided is listed in box 7 of Form 1099MISC, Miscellaneous Income, the payer is treating you as a selfemployed worker, also referred to as an independent contractorYou don't necessarily have to have a business for payments for your services to be reported on Form 1099MISC

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

1099 Contractors and Freelancers Most sharing economy workers are 1099 contractors for tax purposes However, you can avoid 1099 contractor status if you formed a corporation for your business The IRS taxes 1099 contractors as selfemployed If you made more than $400, you need to pay selfemployment taxBecause of the limited scope of the time commitment, an independent contractor is considered to be selfemployed Business owners are responsible for providing Independent contractors with a 1099MISC form instead of a W2, showing the total income paid to the independent contractor 1099 contractor form If you weren't selfemployed, your employer would send you a W2 form that lists your income and all the deductions that were withheld from your pay throughout the year, including federal, state, Social Security and Medicare taxes

1099 Misc Form Fillable Printable Download Free Instructions

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Business & Self Employed EINs and other information Government Entities The 1099 is a reporting form, and it's not the same as trying to file income tax without a W2, which employers use to report wages and taxesSearch form Search Information For SelfEmployed and Independent Contractors Element of CARES Act Pandemic Unemployment Assistance (PUA) This will allow for unemployment insurance benefits to individuals not eligible for regular Unemployment Insurance, such as the selfemployed

Ppp Application Guide For Gig Workers Self Employed Sba Ppp Loan

What Is A W 2 Form Turbotax Tax Tips Videos

Documents you need if you're in business is a sole proprietorship, independent contractor, selfemployed, singlemember LLC If you have employees, you will need to provide the following Note Contractors issued a 1099 are not considered employees Copy of government issued ID (color copy front and back) 19 1040 Schedule C; This is probably the most confusing and improperly calculated tax for 1099 workers To break it down, the selfemployment tax refers to what is typically paid by an employer for Medicaid and Social Security But if you are selfemployed, this tax responsibility falls on you, which means you pay double as both the employer and the employee

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

What Is A 1099 And Why Did I Get One Toughnickel

Everything You Need To Know About Paying Contractors Wave Blog

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

What Is A 1099 And Why Did I Get One Toughnickel

1

How To File 1099 Taxes Online Arxiusarquitectura

W 9 Vs 1099 Understanding The Difference

How To Avoid Paying Taxes On 1099 Misc Fundsnet

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Top 25 1099 Deductions For Independent Contractors

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

About The 1099 Misc Income Box 7 Tax Rule

1099 Misc Form Fillable Printable Download Free Instructions

17 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Irs Tax Form 1099 Misc Instructions For Small Businesses Contractors

What Is The 1099 Form For Small Businesses A Quick Guide

1099 Misc Instructions And How To File Square

W 2 1099 Here S What You Need To Know About Your Employment Status Nailpro

Ultimate Tax Guide For Bird Lime Chargers Updated For 19

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Reporting Income For Grubhub Doordash Postmates Uber Eats Contractors

Ppp Application Form For Self Employed

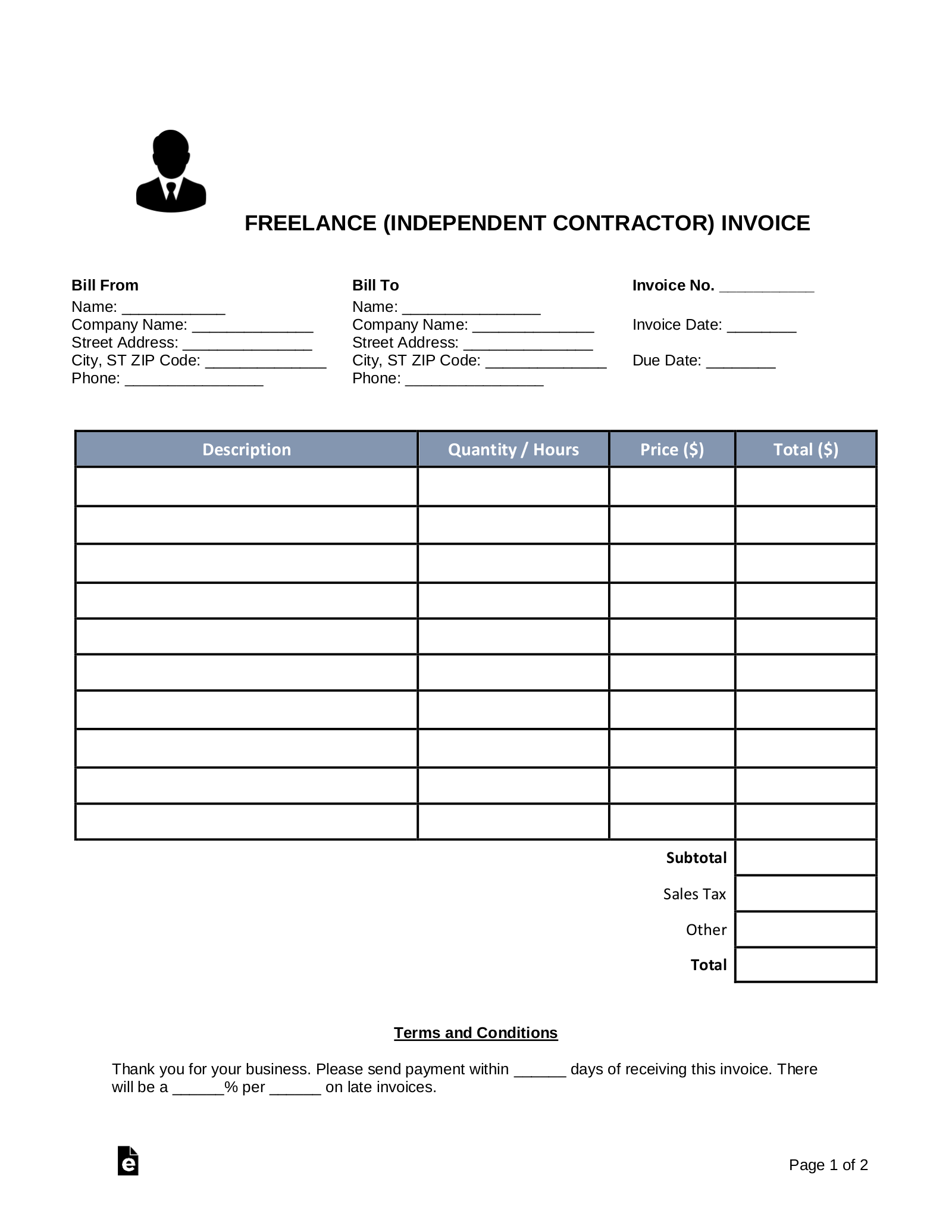

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Misc For Independent Consultants 6 Step Guide

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

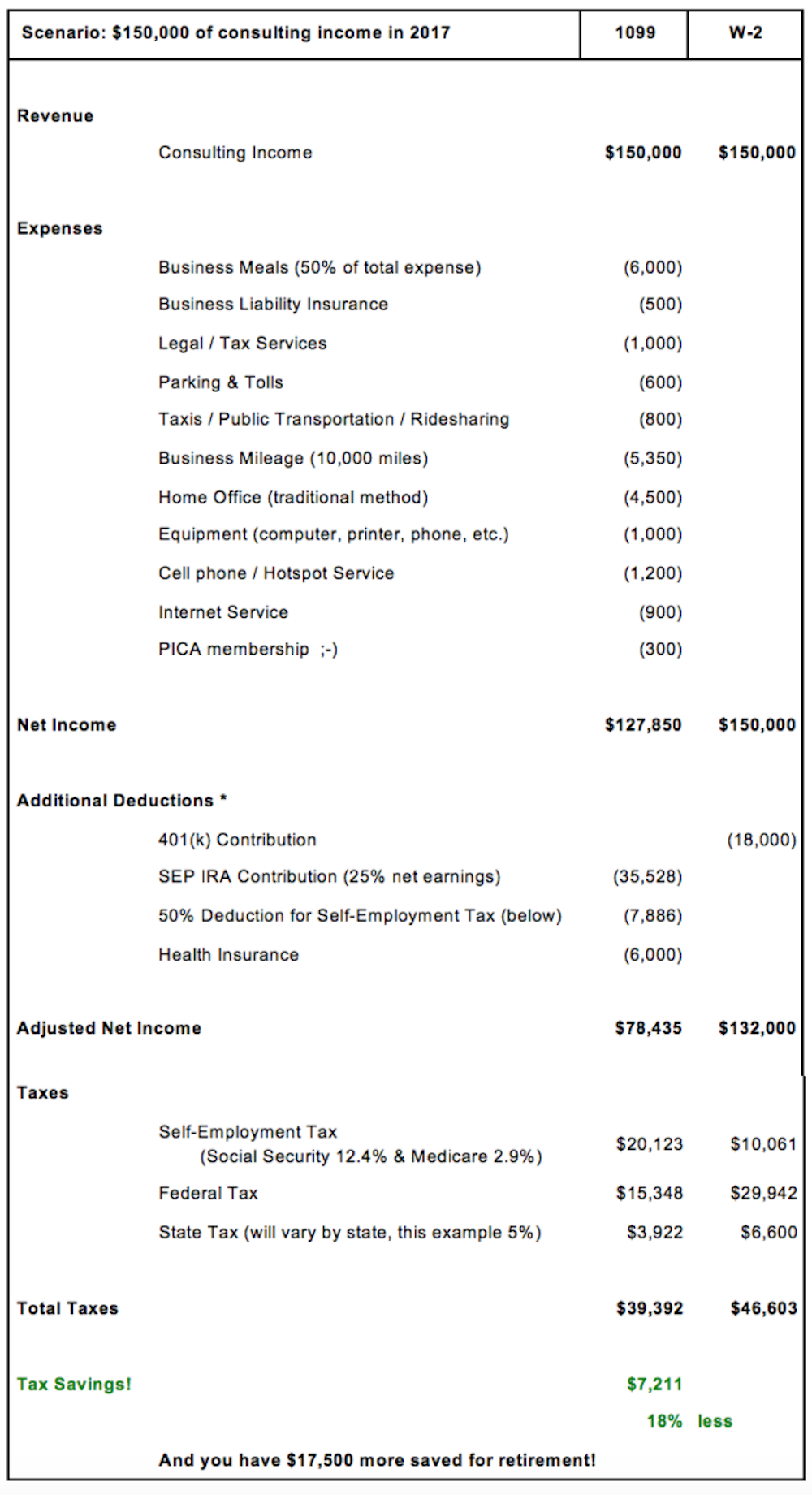

1099 Vs W2 Pica Pica

See Redd Com

3

Free Self Employed Invoice Template Pdf Word Excel

1099 Misc Tax Form Diy Guide Zipbooks

Free Freelance Independent Contractor Invoice Template Word Pdf Eforms

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

Form 1099 Misc Due Date Archives Cozby Company

Independent Contractor Vs Employee What Can These Workers Offer Your Business Paychex

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

Form 1099 Nec Form Pros

Free Independent Contractor Agreement Pdf Word

1099 Misc Form Fillable Printable Download Free Instructions

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Free Independent Contractor Agreement Templates Pdf Word Eforms

How To File Form 1099 Misc For Tax Year 123paystubs Youtube

How To Report Misclassification Of Employees Top Class Actions

1099 Vs W2 Difference Between Independent Contractors Employees

How To File Form 1099 Misc For Tax Year 123paystubs Youtube

Instant Form 1099 Generator Create 1099 Easily Form Pros

Independent Contractor 1099 Invoice Templates Pdf Word Excel

/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

/types-of-1099-forms-you-should-know-about-4155639-2020-83d4b735c1d64ecc93ba821369146618.png)

7 Key 1099 Forms You Need For Business Taxes

New Form 1099 Reporting Requirements For Atkg Llp

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

Form 1099 Nec Instructions And Tax Reporting Guide

Independent Contractor Taxes Guide 21

1099 Misc Form Fillable Printable Download Free Instructions

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

Independent Contractor 1099 Invoice Templates Pdf Word Excel

What Do We Know About Gig Work In California An Analysis Of Independent Contracting Uc Berkeley Labor Center

Cares Act Extends Unemployment Insurance Benefits To Independent Contractors Employment Advisor Davis Wright Tremaine

It S Irs 1099 Time Beware New Gig Form 1099 Nec

How To Pay Tax As An Independent Contractor Or Freelancer

1099 Misc Form Fillable Printable Download Free Instructions

Buy Turbotax 18 Home Business Online Download Ez4tax

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

What Is A 1099 And Why Did I Get One Toughnickel

How To Report Cryptocurrency On Taxes Tokentax

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Tips On Proving Income When Self Employed

0 件のコメント:

コメントを投稿